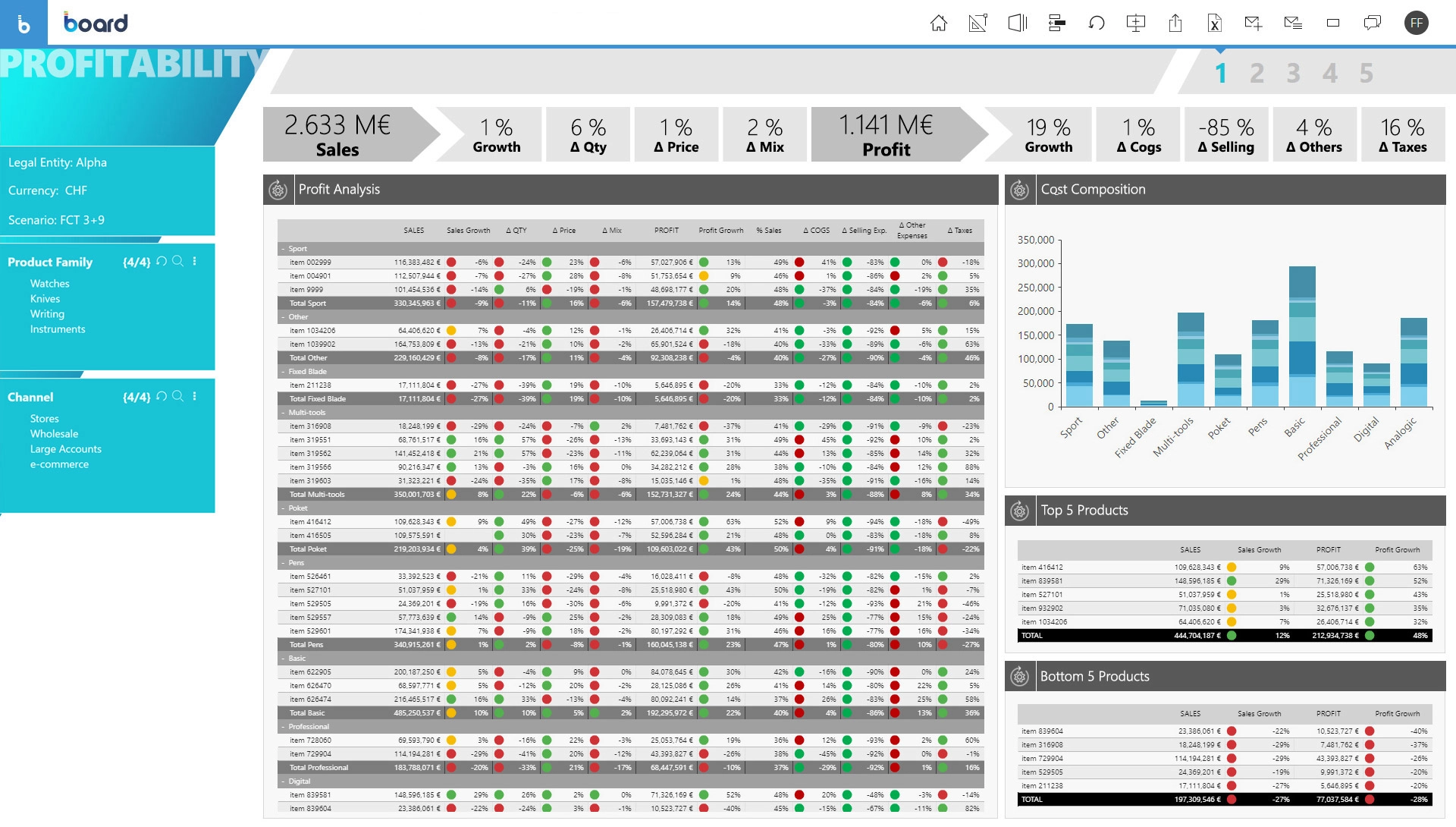

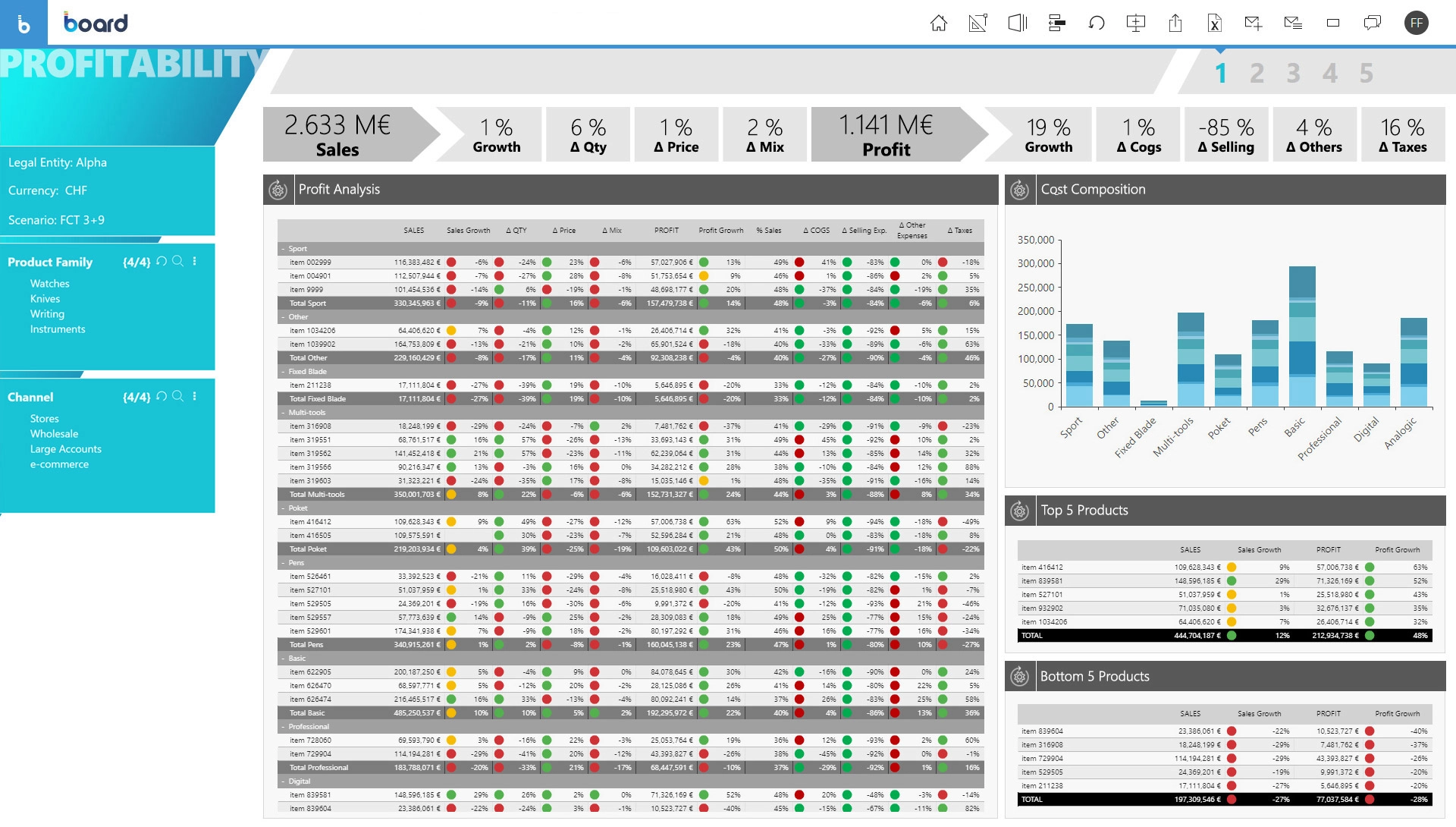

Drive transparency in your profitability analysis

Gain complete visibility of your profitability at all levels of business activity and allocate costs, profits, and capital with ease

Profitability analysis is highly valuable to strategic and operational decision-making but is typically a time-consuming process requiring significant time and effort to conduct. By unifying information from sources business-wide, Board creates complete transparency over the profitability of every business activity in real time, supporting faster decisions and the easy allocation of costs, profits, and capital.

Profitability analysis software for the modern enterprise

Combining business-wide data with Intelligent Planning capabilities, Board enables you to effortlessly conduct profitability analysis without the time-consuming manual workload.

Gain complete transparency of profitability measures

Exhaustive profitability measures with respect to revenues such as:

- Gross margin, acknowledging revenues and all operating variable direct costs

- Operating income, acknowledging revenues and all operating costs including amortizations, write offs, and provisions

- Earnings, acknowledging revenues and all costs

Take advantage of advanced measures and key profitability indicators

Consistent profitability measures with respect to capital such as:

- Return on capital employed = ROCE

- Spread net tax return on capital employed minus cost of capital = (net tax ROCE – wacc)

- Value creation Spread = (net tax ROCE – wacc)*CE

- Return on assets = ROA

- Return on equity = ROE

Accurate cash generation measures such as:

- Operating free cash flow = OpFCF

- Equity free cash flow = eqFCF

Achieve a multidimensional perspective of your profitability

All profitability measures can be analyzed by any significant dimension - from legal entities, business units, markets, and geographical areas to product families, customer types, and distribution channels - at various levels of hierarchy, giving a multi-dimensional view of profitability and cash generation

Easily produce gross margin allocation to single item level

Following a landed cost approach, perform allocation of all variable direct costs such as purchase costs, transportation costs, customs expenditure, and insurance costs to a single shipment, transaction, or item. Compound this allocation with revenues allocation in order to come up with gross margin allocation down to a single shipment, transaction, or item

Understand what really drives your operating profitability with support for different costing methodologies

Following different methodologies such as the cost center approach, activity-based costing, and efficiency-based absorption costing, ensure proper multi-stage and multi-dimensional allocation of all operating costs powered by platform flexibility and business modeling capabilities

Effectively perform capital allocation

Following complex and articulated methodologies, perform proper capital allocation in terms of capital employed, net fixed assets, and net working capital, understanding what really drives your return on capital

Complete transparency of profitability

Creating a multidimensional view of profitability by customer, service, and business unit, Board has enhanced the level of financial detail available to Avaloq. Costs and revenues can now be reallocated from profit centers to projects or from divisions to departments using a series of predefined drivers.

Profitability analysis resources

Explore more of Board’s finance capabilities

Budgeting, Planning, and Forecasting

Seamlessly connect budgeting, planning, and forecasting activities across the organization, saving time by automating repetitive processes and driving visibility, accuracy, and collaboration with an Integrated Business Planning approach.

Learn moreProfitability Analysis, Performance Management, and Analytics

Make more-informed decisions with the ability to analyze profitability, and performance, to simulate the effect of key value driver changes on your business results and to exploit insights from data using sophisticated analytical tools.

Learn moreFinancial Closing, Financial Consolidation, and Lease Accounting

Make light work of closing, consolidation, and lease accounting activities in a compliant, workflow-driven environment.

Learn moreStatutory Reporting, Disclosure Management, and Management Reporting

Exploit the advantages of a single environment to accomplish reporting tasks and disclosure duties.

Learn more