Smarter Financial Consolidation. Faster Close Cycles. Confident Reporting.

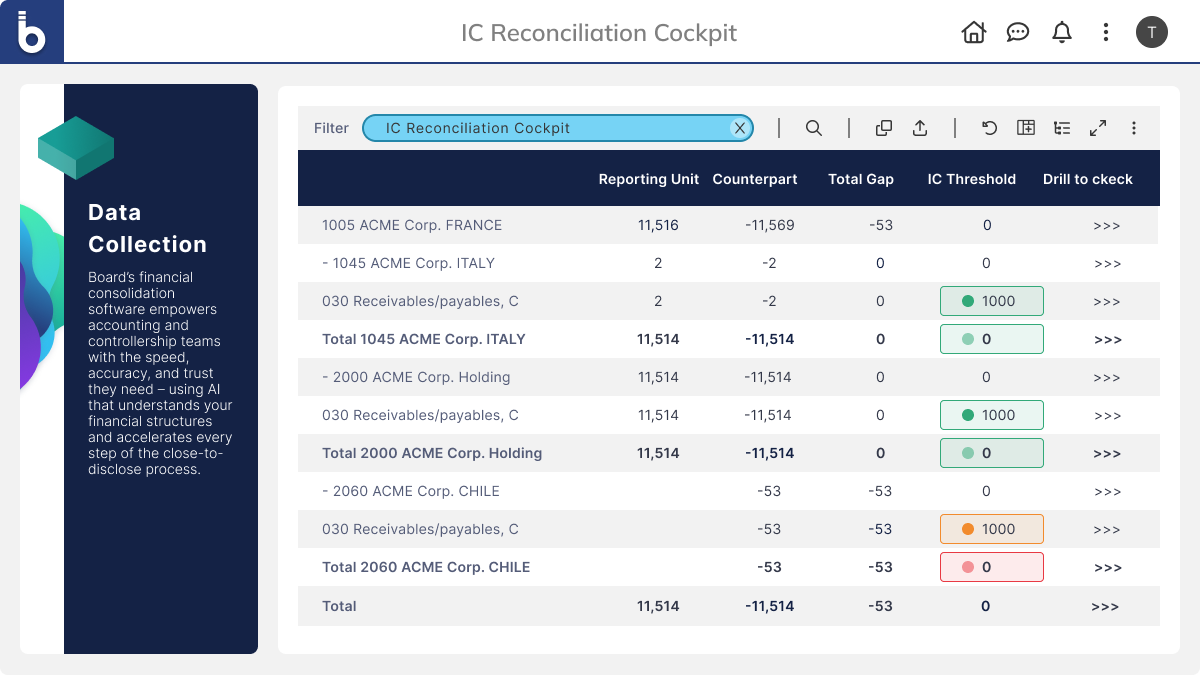

Board’s financial consolidation software empowers accounting and controllership teams with the speed, accuracy, and trust they need – using AI that understands your financial structures and accelerates every step of the close-to-disclose process.

Controller Agent

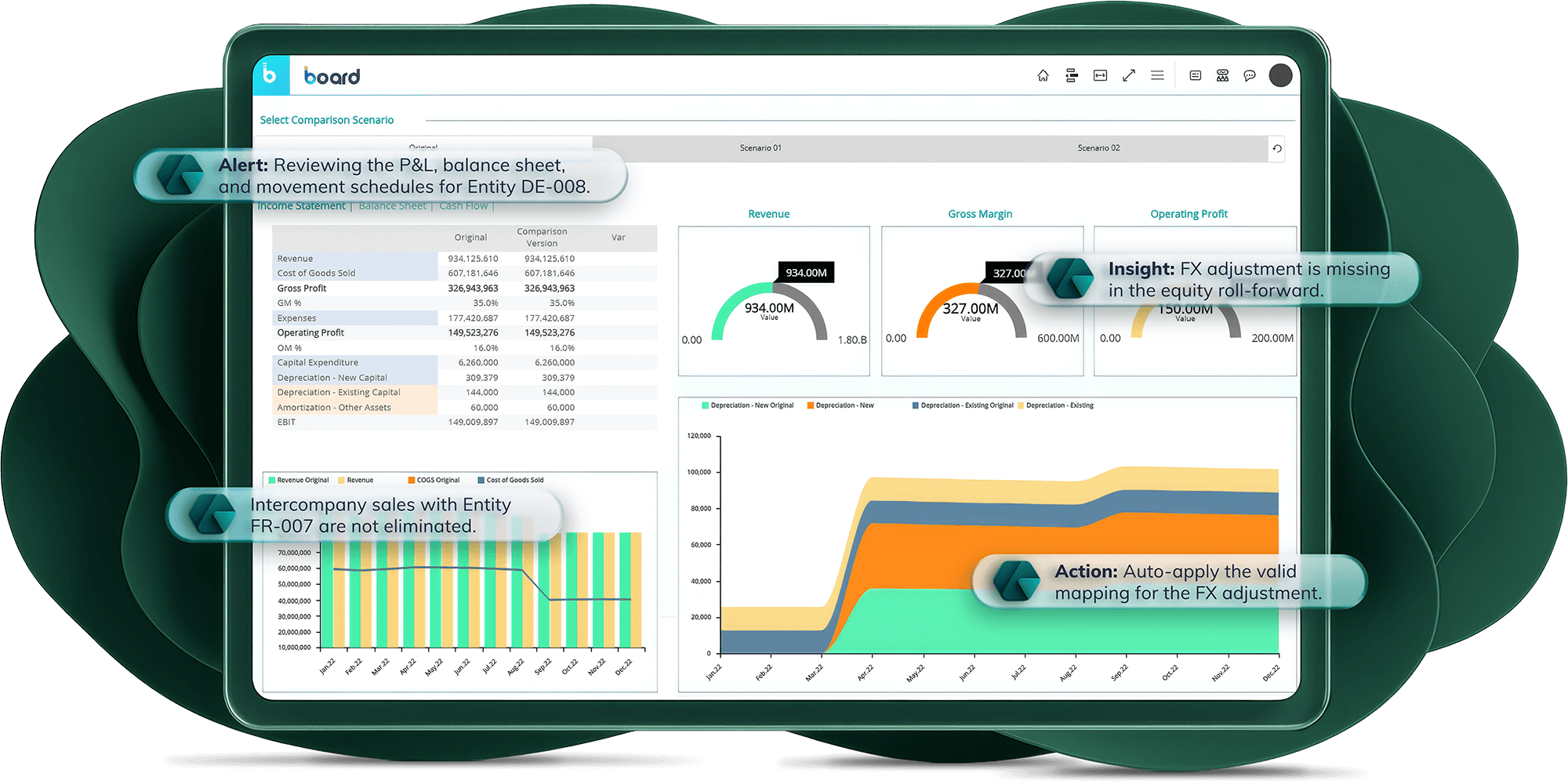

Accounting-aware AI that accelerates close, improves accuracy, and reduces risk, without compromising governance.

The next evolution of accounting intelligence is here.

The Board Controller Agent elevates your financial close by bringing AI to every step of FCCR. It reviews data using accounting logic and historical patterns, surfacing true exceptions, explaining root causes, and guiding teams to resolution faster.

Built for FCCR use cases that matter.

3-Statement Validation

Automatically validate relationships across P&L, balance sheet, and cash flow, reducing errors before they ripple through the close.

Statement Consistency Validation

The Controller Agent validates the consistency and integrity of the P&L, balance sheet, and cash flow statements throughout close and consolidation. It automatically surfaces exceptions and anomalies across entities and reporting structures, helping resolve issues earlier, reduce manual reconciliation, and close with confidence.

Cash Flow Validation

The Controller Agent validates cash flow accuracy throughout close and consolidation by monitoring positions across entities and identifying anomalies, variances, and inconsistencies in real time. It explains root causes, highlights true exceptions, and reduces manual investigation so finance teams close faster with confidence in reported cash positions.

Intelligent Close Readiness

The Controller Agent analyzes every package with rule-driven consistency checks informed by accounting logic. It pinpoints anomalies, explains root causes, and proposes corrections so teams resolve issues before they before they impact close timelines or audit outcomes.

Intercompany Fast Match

The Controller Agent automatically matches intercompany balances using learned patterns and highlights only genuine mismatches. It guides users to the right resolution path, cutting manual investigation time and tightening the overall reconciliation process.

GL Mapping Optimization

The Controller Agent studies historical posting behavior to recommend the most accurate general ledger to consolidation mappings. It flags stray or inconsistent accounts and keeps structures aligned, reducing rework and improving downstream reporting quality.

Board Financial Close, Consolidation, and Reporting (FCCR) enables delivery of fast, accurate and compliant results.

Overcome system silos, slow closes, and global complexity with automated consolidation powered by AI, delivering audit-ready transparency and trusted reporting of performance.

Unified Financial Close & Consolidation

Streamline entity reporting, currency translation, eliminations, and adjustments on one governed platform with full auditability and compliance across IFRS and GAAP.

Controller Agent

Enhance accuracy with an accounting-aware AI agent that detects inconsistencies, explains variances, and recommends corrective actions, reducing manual checks and detective work without compromising control.

Auditability & Trust

Ensure transparency and compliance with complete audit trails, validation checks, and traceability across entities, journals, and consolidation layers.

All your financial close, consolidation, and reporting needs covered.

Financial Consolidation and Reporting (FCR)

Automate consolidation processes with unified workflows, built-in accounting logic, and AI-driven data validation.

Disclosure Management

Create, review, and file compliant reports faster with connected data, role-based workflows, and XBRL/iXBRL automation.

ESG/CSRD Reporting

Standardize ESG and CSRD data collection, calculate emissions, and deliver audit-ready sustainability disclosures.

Lease Accounting

Centralize lease management and automate IFRS 16 / ASC 842 calculations, remeasurements, and disclosures.

Tax Reporting

Streamline tax data collection, ETR calculations, and Pillar 2 / CbCR compliance with integrated workflows and validation.

Trusted by enterprise finance teams worldwide.

What controllership teams say about Board

See Board in action.

Watch how a leading controllership team uses Board to accelerate close cycles, planning and reporting – navigate audit trails with confidence, without sacrificing governance or control. Powered by accounting-aware AI embedded directly into the close and consolidation process.

See more in a personalized demo

Recognized by analysts. Trusted by finance leaders.

Board is globally recognized by analysts, peers, and subject matter experts.

Board is a Challenger in the 2025 Gartner® Magic Quadrant™ for Financial Close and Consolidation Solutions (FCCS).

Get the reportBoard is a Leader in the 2025 Gartner® Magic Quadrant™ for Financial Planning Software.

Get the reportBoard scored among the four highest-ranked (tied) vendors in the 2025 Gartner® Critical Capabilities for Financial Planning Software.

Get the report

Financial Close, Consolidation and Reporting resources.

The 2025 Gartner® Magic Quadrant™ for Financial Close and Consolidation Solutions (FCCS)

Disclosure Management for the Modern Enterprise

Finance Transformation: Turning Agility into Advantage

The Rise of Agentic AI in Finance: From Automation to Autonomy

Why Your Planning Teams Need Board Foresight Before 2026: The Predictive Advantage for Confident, Continuous Planning

FAQs

Board accelerates the financial close by automating consolidation, aligning actuals with plans, and reducing manual reconciliation.

Board unifies close, consolidation, and reporting with automation, AI, and audit-ready workflows.

Yes. Board seamlessly connects with leading ERP, BI, and more data sources for real-time data flow.

Absolutely. Board automates GAAP/IFRS rules including eliminations, ownership changes, FX translation, and audit tracking.

Yes. Sustainability reporting aligns with consolidation data through Board’s unified platform and Disclosure Management (Iris Carbon).

No. The agent augments accounting teams by flagging issues, offering recommendations, and providing explanations. Final approval and accounting judgment always remain with you.

Trusted by 2,000+ global enterprises across manufacturing, CPG, financial services, technology, and more.