Budgeting of clinical trials

The implementation of clinical trials is associated with immense costs for the performing company as …

The uncertainty of today’s fast-paced world is requiring the planning process to evolve to an agile, responsive, and flexible capability.

Anticipating and reacting to change means Banks must be able to quickly generate multiple “what-if” forecasting scenarios and evaluate them across numerous dimensions -considering constraints such as capital and liquidity.

This driver-based planning application provides a solution which materially reduces delivery time and helps to address these key questions:

What should the shape of the bank look like across retail asset/liability classes to meet shareholder return targets within the capital and liquidity constraints?

- How can we automate forecasting the Bank’s full Balance Sheet to meet regulatory asks?

- How would improved utilization/drawdown rates for cards impact product balances, income, impairments, direct and indirect costs?

- How can we plan and analyze impact of management actions to close the gap between the latest forecast to the Group targets?

A solution by KPMG Germany

The application consists of a driver-based group planning and a driver-based product planning module. The top-down group planning module is where group finance could use the tool to shape the bank and set targets on legal entity level. Once these group targets are set control a bottom-up planning on a product level in the product planning module would follow. Here, the user has the ability to plan how to reach the group targets. Once complete, the planning flows back into the group module and could then be reviewed and approved.

Group Planning Module:

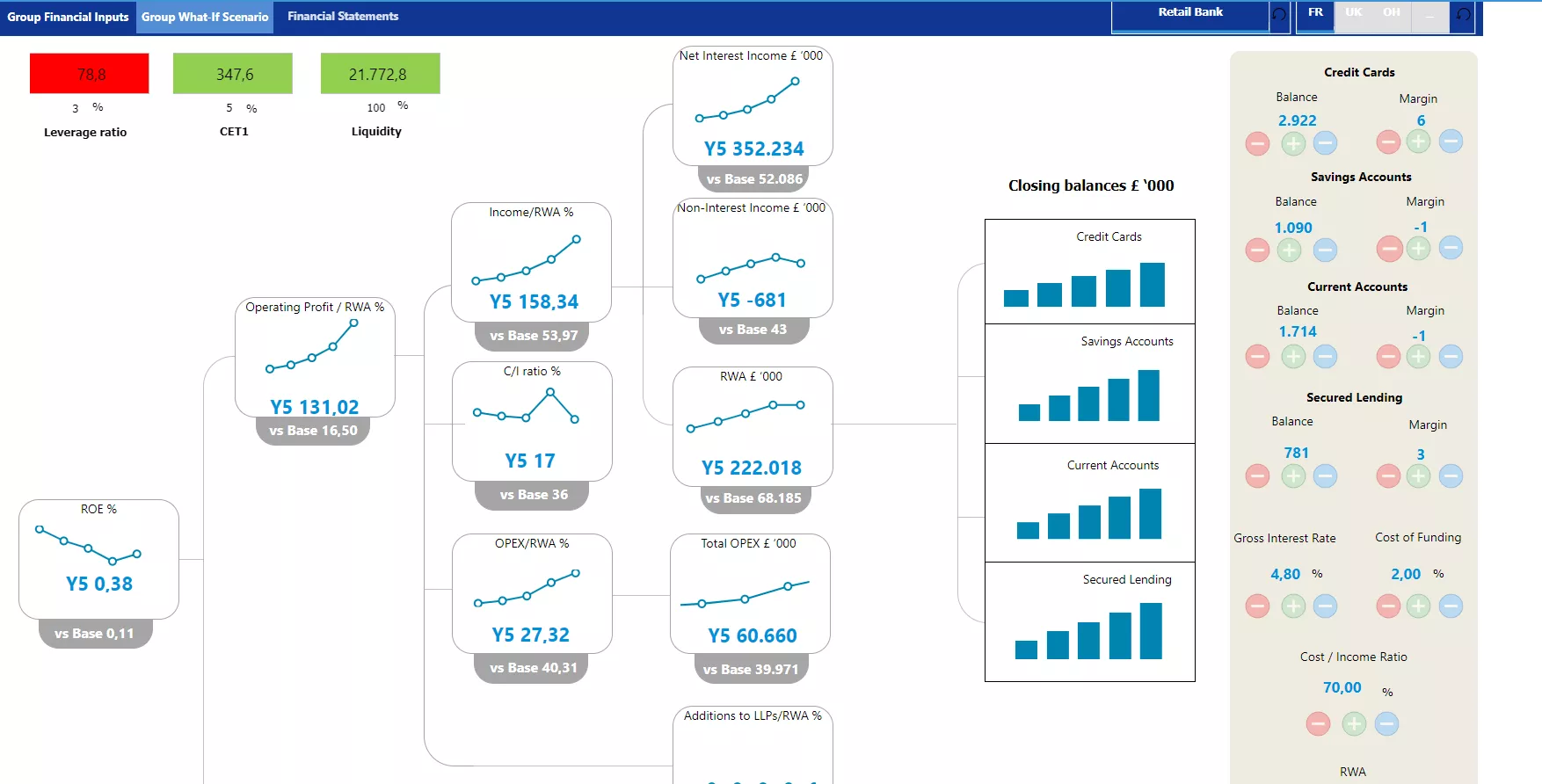

Most of the banks use return on equity as some form or another as a strategic KPI hence the group driver which this tree seeds off is return on equity. The user has scenario levers which can be changed to better understand the impact on return on equity in real time. These levers are essentially the balance and margins for the bank’s product set. A couple of macroeconomic levers are also available such as interest, cost of funding, target cost income ratio, target pay out and share price. This planning module also allows the user to feedback in real-time whether the planning is hitting any capital constraints.

Product Planning Module:

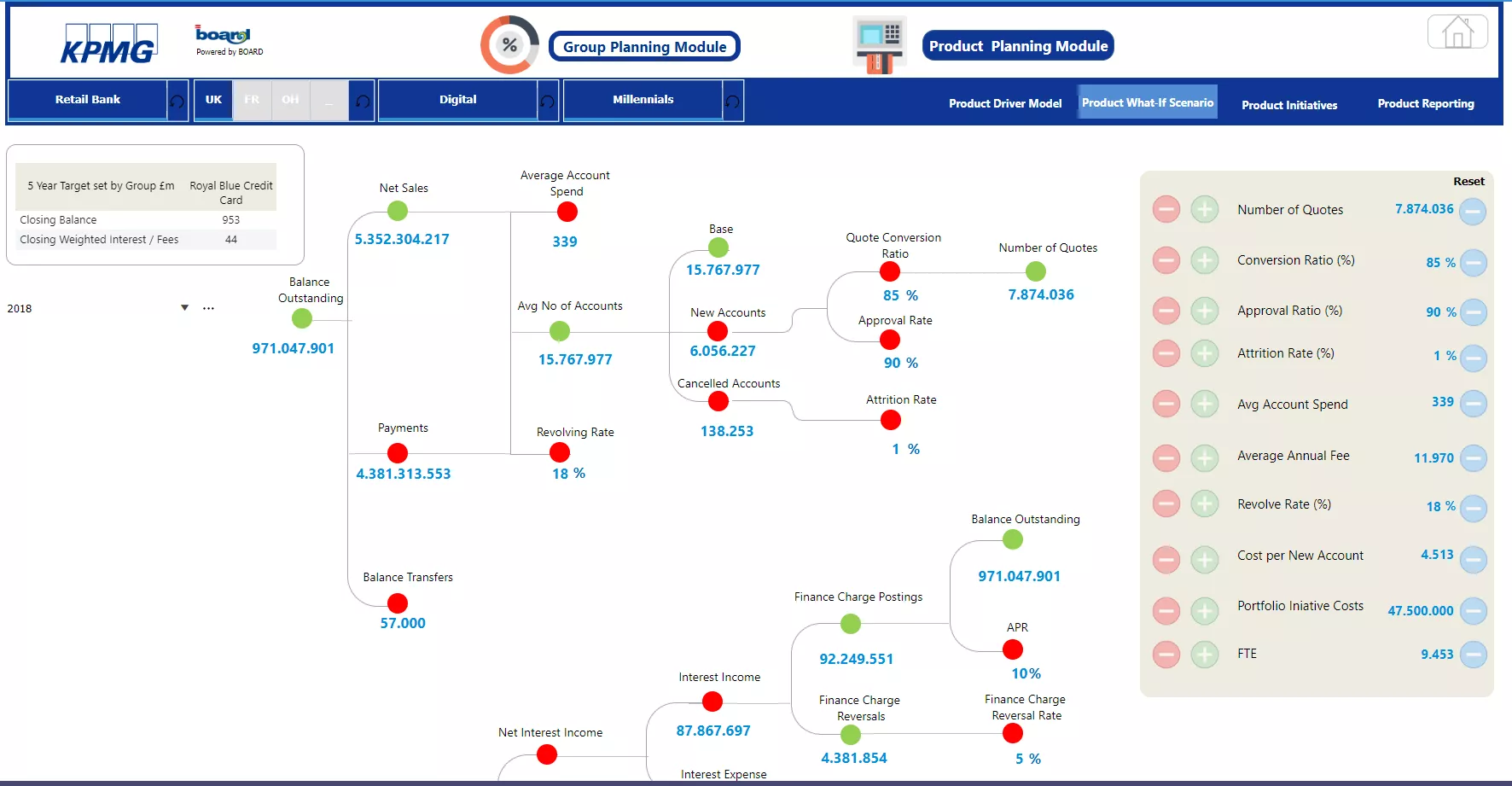

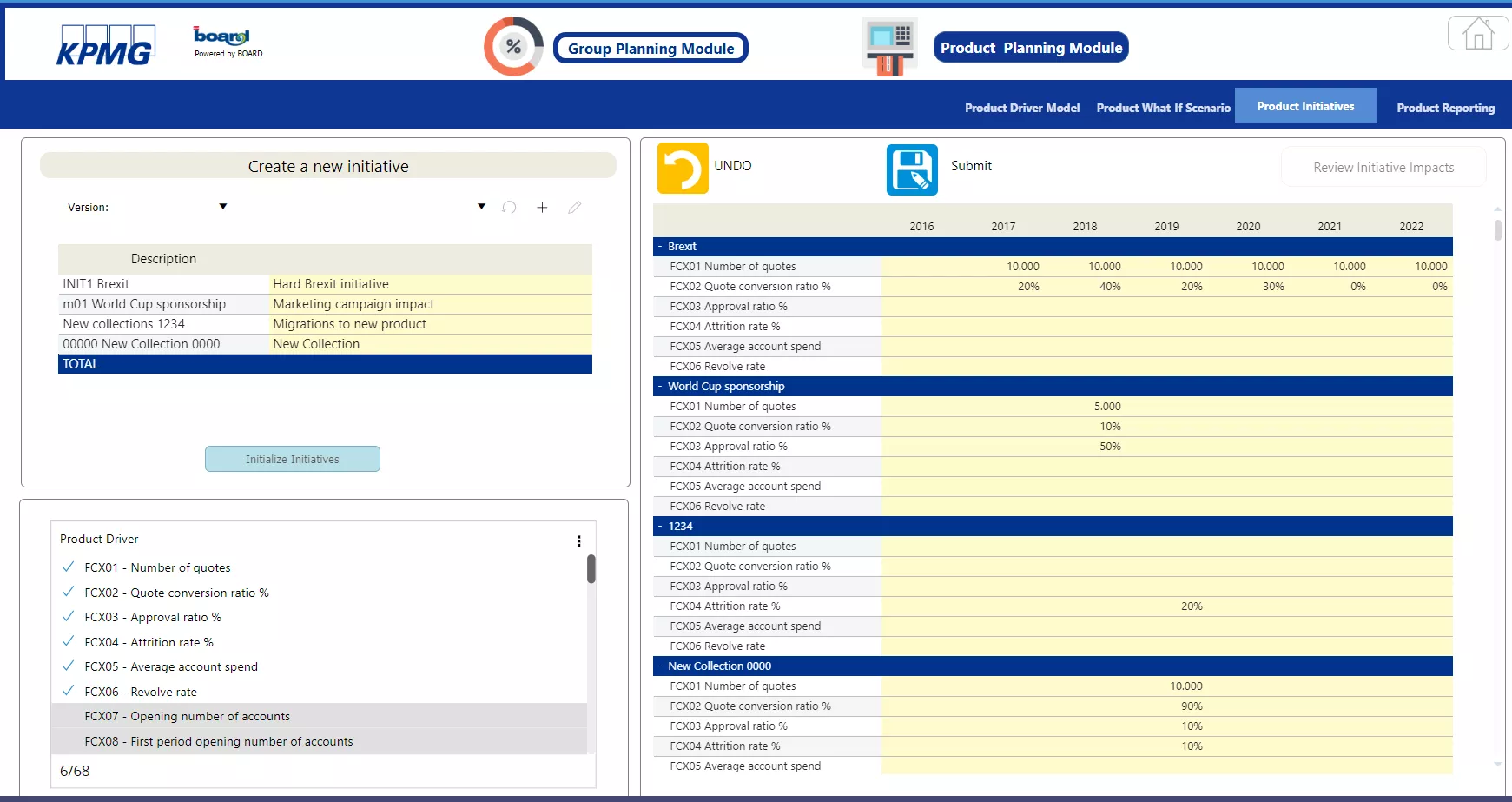

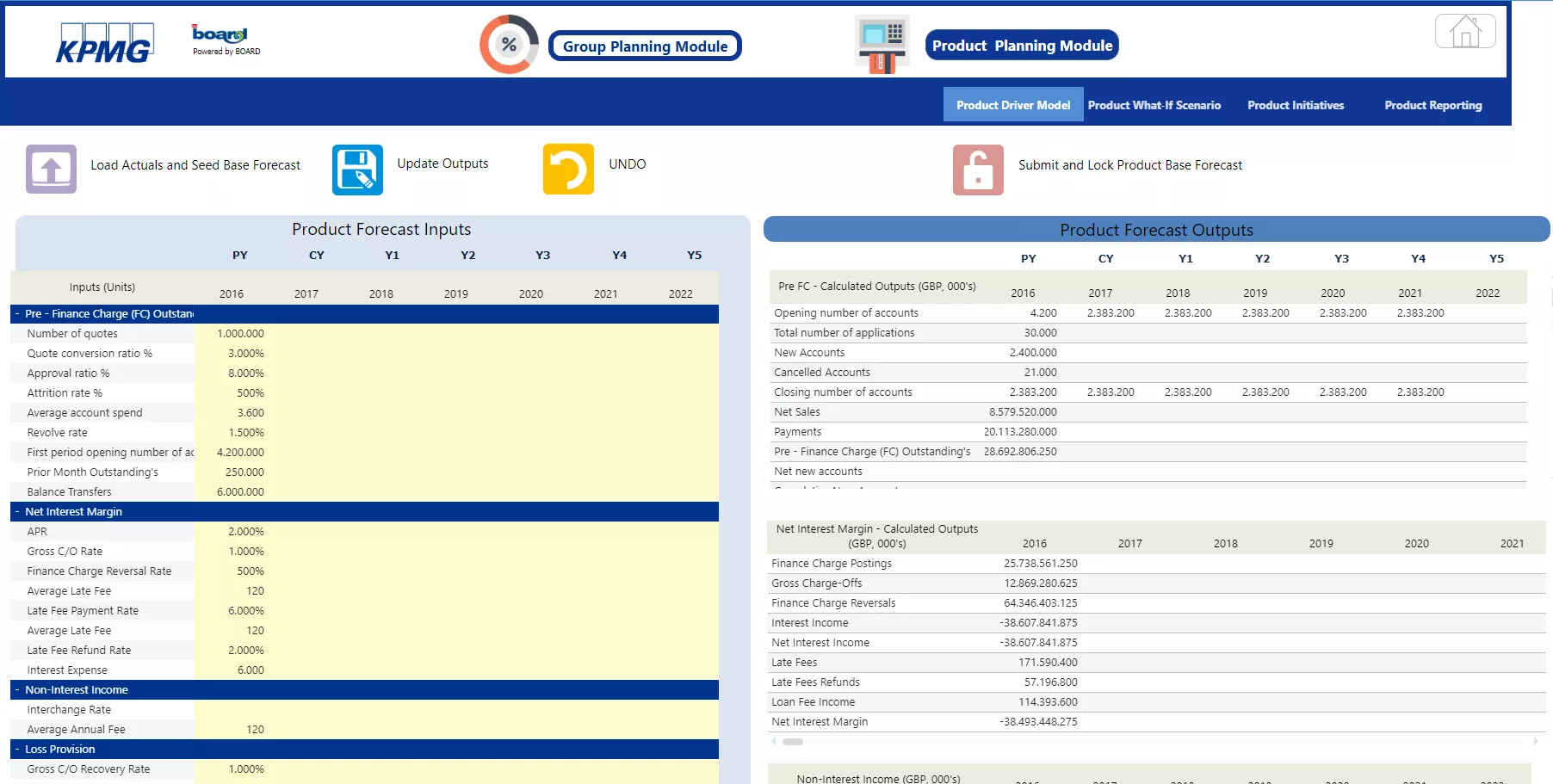

The product driver planning tree consists of about 50 pre-defined drivers. Not all drivers are equal in terms of materiality. To ensure the possibility of a fast and flexible forecast, the user can change 10 key drivers and see the impact on profit and balance immediately. So, the user can easily match product planning to the targets from the group. Moreover, the tool gives the ability to plan certain initiatives and put the user in a position to understand how management actions could close the gap between forecast and group targets.

Group Planning driver mask with the possibility to change levers and to monitor keeping capital constraints

Product Planning driver mask with the ability to play around with the 10 key drivers and to see immediately the impact on profit and balance

Screen to create new initiatives and to set product driver

This screen allows to state almost immediately and in parallel what are the impacts of all driver inputs on outputs.

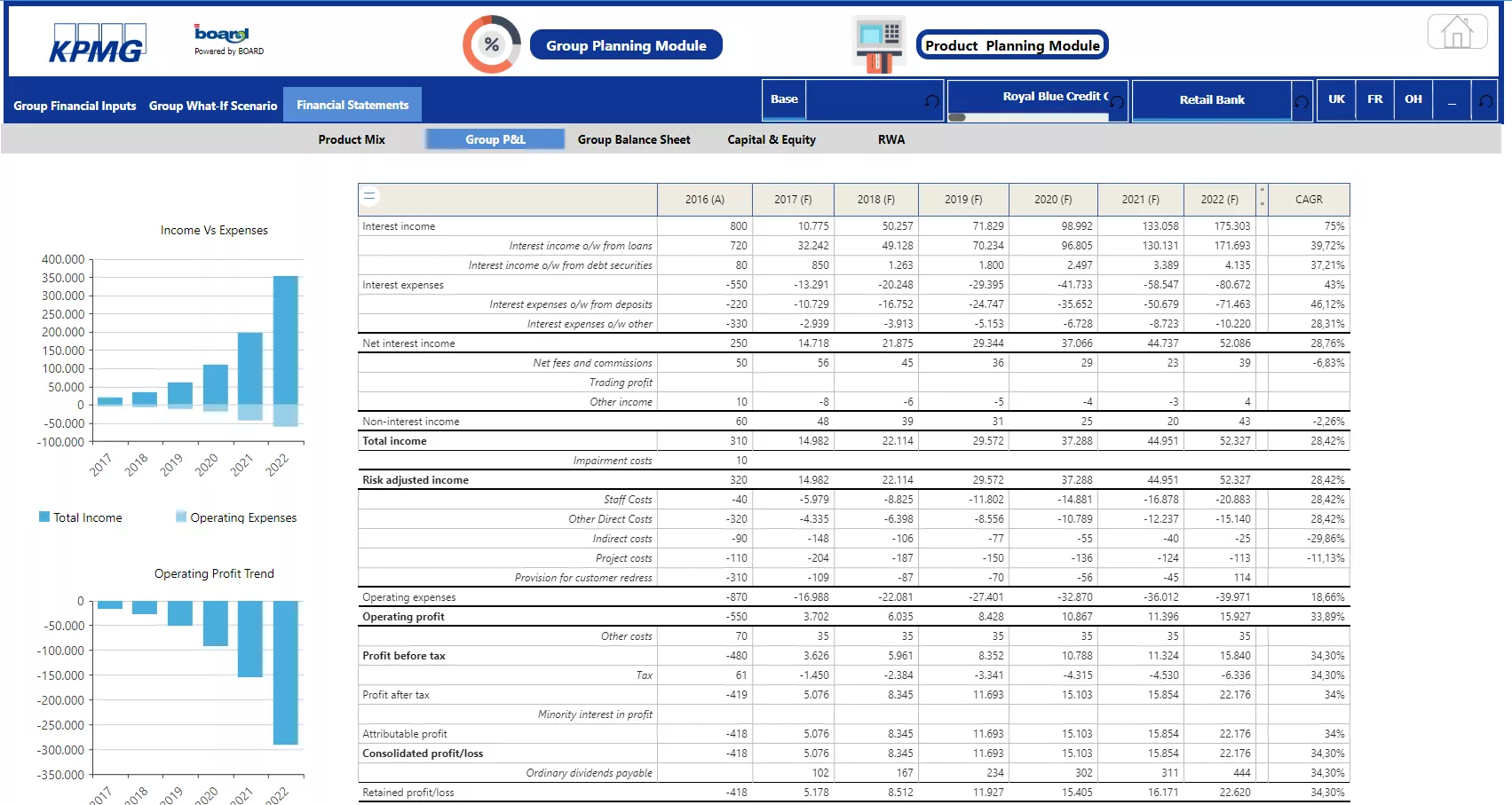

This Screen shows the group PnL after finishing group planning and product planning

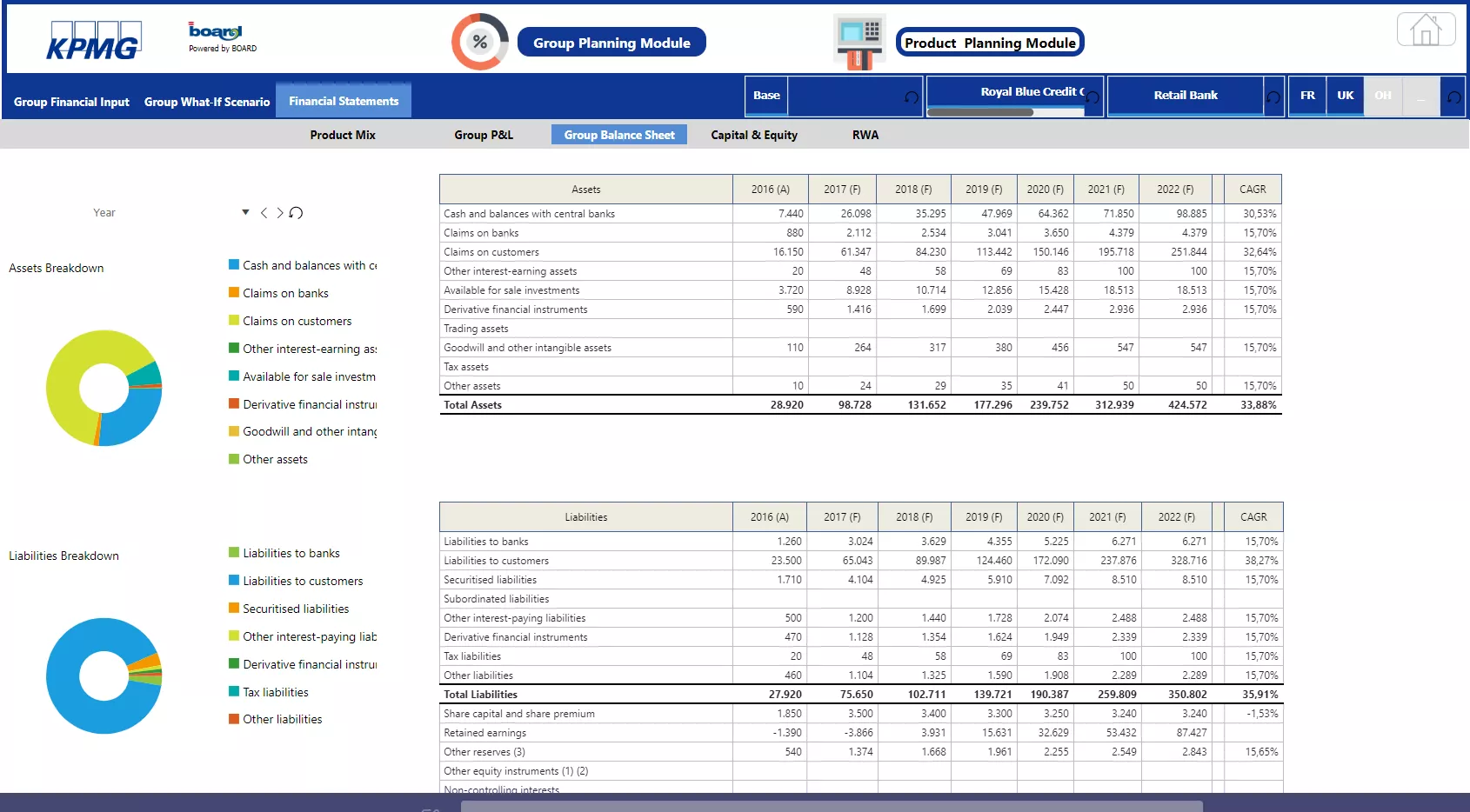

This Screen shows the group balance sheet after finishing group planning and product planning.

The implementation of clinical trials is associated with immense costs for the performing company as …

Both during and after times of crisis, such as COVID 19, companies may find several reasons for …

Successful growth in companies is often linked to a multitude of initiatives that present project …

The topic of Environmental, Social & Governance (ESG) is becoming increasingly important for …