Delos Power is Italy’s leading operator of photovoltaic power stations and the second-largest generator of electricity from photovoltaic sources. To support the company’s growth in a way that is both agile and meets the needs of a highly complex corporate structure, Delos opted for the Board Intelligent Planning Platform. With Board, the organization looked to integrate its finance area with the operational activities of the solar power plants, led by a collaborative model. The result is an end-to-end process spanning economic and financial planning and budgeting; reporting and analytics (using all the group’s information assets, including monitoring the plants’ performance and productivity); and the complete financial consolidation cycle.

The common denominator of the Board project at Delos Power is the unification of planning, reporting and financial consolidation, which has been achieved by integrating the finance area with the operational activities of the photovoltaic power stations

Massimo Travella

Delos Power is an Italian asset management and O&M Group responsible for a portfolio of photovoltaic power stations. It manages all the solar power plants owned by the Tages Helios and Tages Helios II closed-end reserved real-estate funds managed by Tages Capital SGR S.p.A.

With its highly specialized team, Delos Service – a Delos Group company – has supported the Tages funds with the rapid growth they have achieved through mergers, acquisitions, and refinancing operations over the past five years. With these funds, the group has invested in photovoltaic systems worth over €1 billion, achieving 405 MW of installed power.

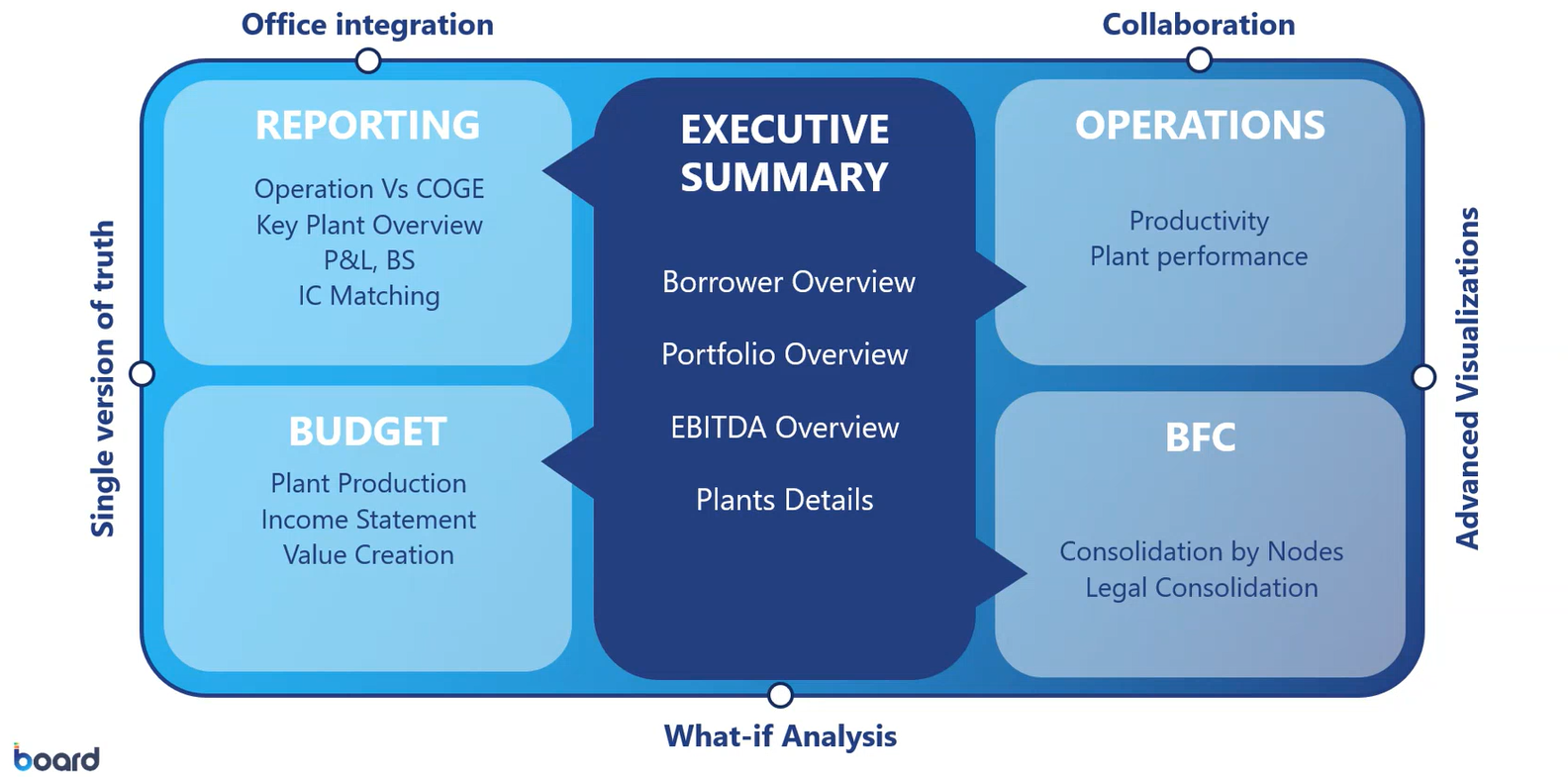

Unification is the common theme of the Board project at Delos Power. By integrating the finance area with the operational activities of the plants, an end-to-end process is created, which:

- spans economic and financial planning and budgeting

- enables reporting and analytics using all the group’s information assets, including monitoring solar power plants’ performance and productivity

- completes the financial consolidation cycle.

Board was first implemented across the entire control and analysis area, creating a single point of truth fed directly by the company’s ERP. The Board platform has become a control tower for Delos’ everyday activities, where operational information aligns with accounting data in real-time. Given the complex structure of the Delos Group, which comprises over 60 companies and 174 photovoltaic power stations, the company needs an information source capable of combining finance with operations. The solar power stations’ sites and companies are ordered according to various criteria (e.g. acquisition portfolio, geographical areas, financing banks, and so on) to create multiple consolidated and sub-consolidated accounts:

“We have managed to replicate our corporate structure clearly on the Board platform and have gained access to a very flexible management tool,” explains Marco Sterpi, Head of Reporting, Finance & Treasury. “When we acquire a new solar power plant, it’s easy to update the structure. We work directly on the Board database and automatically import the accounting information from the company ERP, thanks to the seamless communication between the BI platform and our business management system.”

When comparing and integrating the revenue data booked in the accounts by the finance area with the revenue data from Delos’s proprietary plant monitoring system, broken down by type (revenues from incentives, electricity, or guarantees of origin), the effectiveness of unified analytics and reporting processes is seen:

“Thanks to Board, we have achieved fast and smart synergy between Management Control and the Operations Area, giving us higher-quality information, secure validation of said information, and consistent data throughout the organization. We are also minimizing the use of spreadsheets and considerably reducing the margin of error,” observes Massimo Travella.

The data quality provides a solid basis for building reports and analyses, particularly cost analyses for specific periods, companies, and the general ledger account at both an overview and itemized level. It also considers the variations between the current year and the previous year while constantly monitoring the difference between budget value and actual value. As Marco Sterpi points out,

“Board’s functions enable us to see the big picture across our information assets, so we can then focus on different levels of granularity, according to our needs. For example, we can look at a single portfolio or at each company belonging to that portfolio, right down to individual photovoltaic power station.”

Delos has also used Board to build an application for analyzing costs graphically and intuitively, in such a way where the percentage of total cost and the corresponding budgets of each cost item, business unit, or company accounts is identifiable.

“The introduction of these new Board applications has saved us a great deal of time because, previously, it used to take us ages to do the preliminaries before doing the actual analysis. We used to have to download about 60 trial balances – one for each company – one at a time from the ERP, and then import them into spreadsheets and join them together with pivot tables. Before we adopted the Board solution, it used to take us several days to prepare the files before we could even start analyzing the data!” remembers Marco Sterpi.

Delos also uses applications built with Board at control level, including intercompany transaction analysis (IC matching) using advanced drill-down capabilities. To do this, Delos has grouped the intercompany general ledger accounts based on specific criteria: from financing between the parent company and its subsidiaries to service provision or fiscal consolidation.

Marco Sterpi notes:

“Here at Delos, our organizational structure is very complex and layered, so we generate intercompany transactions – both economic and capital – that need to be managed in a similarly complex and demanding way. Using Board, we assign a “tag” to each intercompany general ledger account according to the nature of the account concerned, thus creating specific groupings. This makes everything much easier and more user-friendly to manage, thanks to clear, intuitive selection functions, and speeds up the performance of this important control process.”

Collaborative planning: Finance and operations in a single performance management environment

The analytics environment on the Board platform integrates with Delos’ financial planning process. The database that feeds the planning process is the same one used to carry out the analyses and generate the reports. This means Delos’ Office of Finance fully aligns with operations, not just in terms of business intelligence but also at every stage of financial budgeting.

“Initializing the budget with the Board solution enables us to load information from final accounting data or previous budgets for each cost item. This means we can build various budget versions according to our business needs so that we don’t get snowed under with heaps of separate spreadsheets,” adds Marco Sterpi.

Delos’ economic and financial planning and control teams can now collaborate in real-time with the operational teams are advantageous, given the need to adapt to the changes and variations seen in the photovoltaic systems. As Marco Sterpi explains,

“The unification provided by Board, both between planning and analytics and between finance and non-finance areas, makes it simple for us to manage changes. For example, we can evaluate the individual portfolio and arrange the budget by general ledger account, individual reporting unit, supplier, or individual plant. We can also build a workflow by portfolio type to keep track of every planning stage in an interactive, collaborative process.”

Smart communication between the monitoring system and Intelligent Platform

The finance area is fully integrated and synergized with operations and management control thanks to Board’s ability to interact intelligently with the proprietary system Delos uses to monitor the solar power plants. This monitoring system collects a vast range of information from the various components of the photovoltaic power systems, such as the size of the site, how many inverters are in operation, and the number of field cabinets.

“There’s a total of about 7 billion records! Board only collects the necessary data for operational reporting and analytics and for economic and financial planning and budgeting. This interaction gives us end-to-end standardization and industrialization of BI and Corporate Performance Management processes, which enables us to check, in real-time, whether the financial information booked in the accounts matches the operational information recorded by the solar power plant. What’s more, revenues imported into Board can be used automatically in What-If analyses thanks to the platform’s simulation and business modeling capabilities,” explains Marco Sterpi. “Various dashboards represent the interaction between finance and operations, including dashboards that show us the best and worst solar power plant in terms of production and profitability against the budget and the previous year. Similar evaluations are carried out by analyzing average solar radiation by geographical area.”

Guiding Financial Consolidation

After completing the planning and analysis process, Delos uses the Financial Consolidation solution developed with Board to create consolidated accounts at an individual portfolio and sub-holding level. This also incorporates generating the consolidated financial statements across the entire group.

After importing data directly from the accounting records (the company ERP), the Financial Consolidation process is integrated with relevant management records. The next stage, reconciliation of intercompany items, is strictly limited to companies whose accounting is not managed directly by Delos. This is because the intercompany transactions of internal companies are checked daily by management control using the Board application to perform checks on reconciliations in advance and specific elimination rules on certain accounts.

“Board also enables us to analyze – in the same environment where consolidation process is implemented – the relationships between the companies in our group. For example, we can observe the breakdown of commercial or financial payables and receivables of one or more companies,” adds Marco Sterpi.

After entering – in the subsequent adjustment phase – any management records that fall outside the scope of those used for standard consolidation, the actual consolidation procedure is launched. It ends with the generation of consolidated and sub-consolidated accounts and related reports.

For transparency of this key data, it is vital to be able to view every step of the consolidation process (such as loading, elimination method, accounting principles, and so on). The Board Financial Consolidation solution manages the entire disclosure phase, based on the collection and approval of the various parts of financial statements which make up the required documentation.

“Board makes these procedures much easier for its end-users in the finance team by giving them access to the software’s features on a self-service basis with full autonomy,” concludes Marco Sterpi.