Financial Planning & Analysis

Intelligent Planning for FP&A teams.

Enhance your planning process. Ensure accurate, real-time data. Empower your organization to react at the speed of business. All with one Intelligent Planning Platform.

Enhance your planning process. Ensure accurate, real-time data. Empower your organization to react at the speed of business. All with one Intelligent Planning Platform.

91%

90%

75%

91%

finance efficiency90%

automation of data input75%

reduction in planning timePlan for performance.

Accelerate planning cycles

Realize a rapid, seamless planning process that ensures complete alignment among relevant stakeholders.

Enable business partnering

Empower your team with real-time insights needed to strategically guide the organization toward profitable performance.

Focus on delivering insights

Reduce the time spent collecting data and past performance and make your process more agile to drive long-term strategy.

Integrate your processes

Connect data across systems, align departments around one platform, and ensure everyone uses a single version of the truth.

Collaborate flexibly

Allow planners across the organization to simultaneously work together through shared dashboards and a built-in chat interface.

Level up to xP&A

Expand planning beyond the finance function and realize a best practice extended planning and analytics (xP&A) approach.

We needed a planning system which integrates all planning processes. We needed a future-oriented planning system. We needed Board.

Solutions that take you from spreadsheet to superhero.

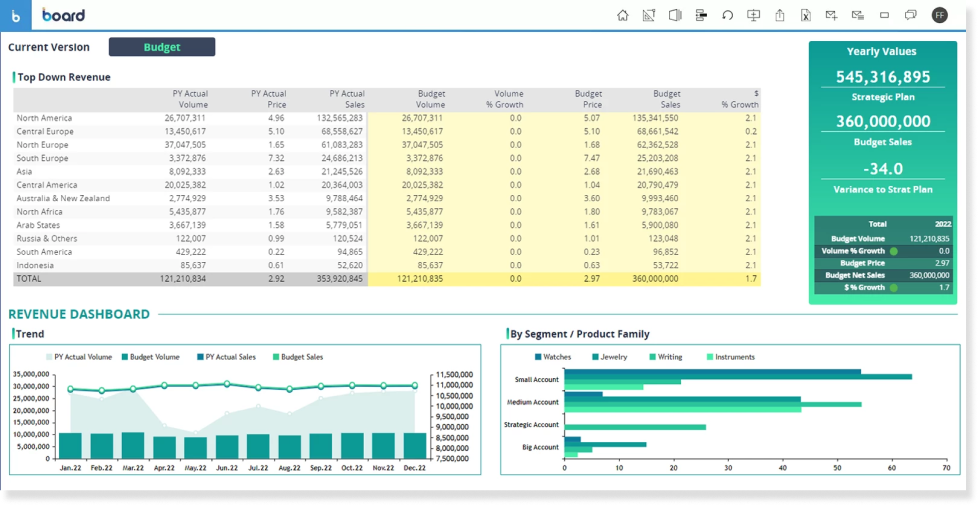

Futureproof your FP&A.

Seamlessly connect budgeting, planning, and forecasting activities across the organization, saving time by automating repetitive processes and driving visibility, accuracy, and collaboration.

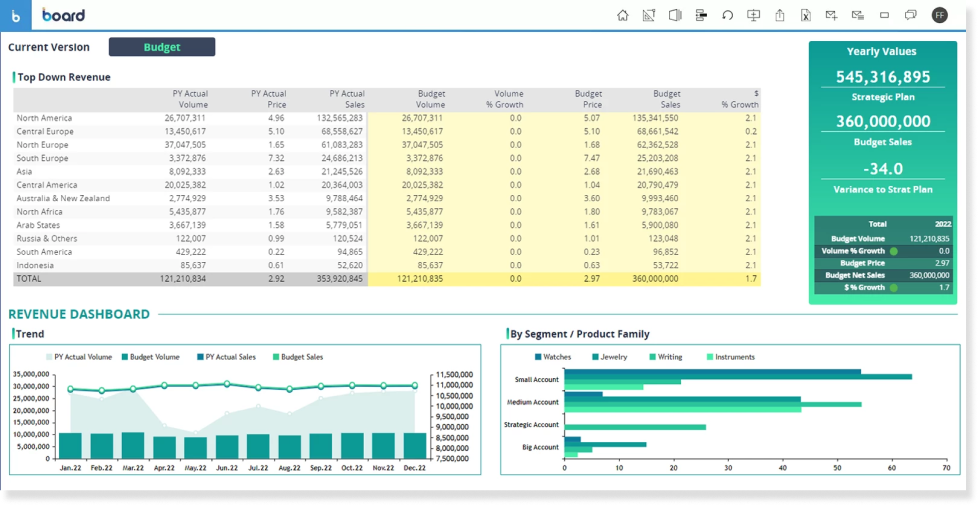

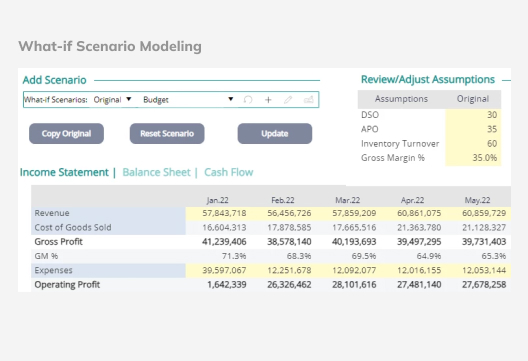

Plan for the future.

Create what-if scenarios in an agile environment that adapts to your company and market's needs. Formulate long-term goals that translate into actionable plans.

Optimize capital allocation.

Evaluate your capital needs, ensure the best possible use of your resources throughout multi-year project cycles, and rely on real-time and cross-functional data and analysis.

Real-time business insights.

Analyze performance and profitability, create and customize dashboards in seconds, and simulate the effect of key value driver changes. Stay ahead of the competition by leveraging AI to conduct advanced predictive analysis.

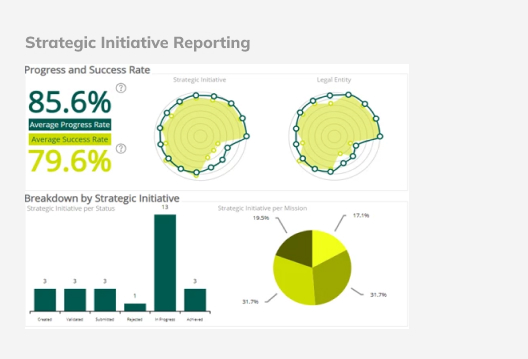

Align your decisions to accelerate execution and deliver strategy.

Bridge the gap between finance and operations with a holistic IBP solution that combines the Class A standard IBP process from Oliver Wight with industry-leading Intelligent Planning from Board.

We are a Leader in the 2023 Gartner® Magic Quadrant™ for Financial Planning Software.

Built for success.

Solutions are built on the Board Intelligent Planning Platform. It delivers:

- The flexibility to adapt at the pace of market change.

- The performance of a powerful planning machine that analyzes at scale.

- The scalability to incorporate new drivers in a user-friendly application.

Resources to stay ahead.

12 Best Practices in FP&A

Intelligent Transformation with FP&A Trends Maturity Model

The Total Economic Impact™ of the Board Intelligent Planning Platform