Adaptive Resilience Model - Risk Management and Financial Planning

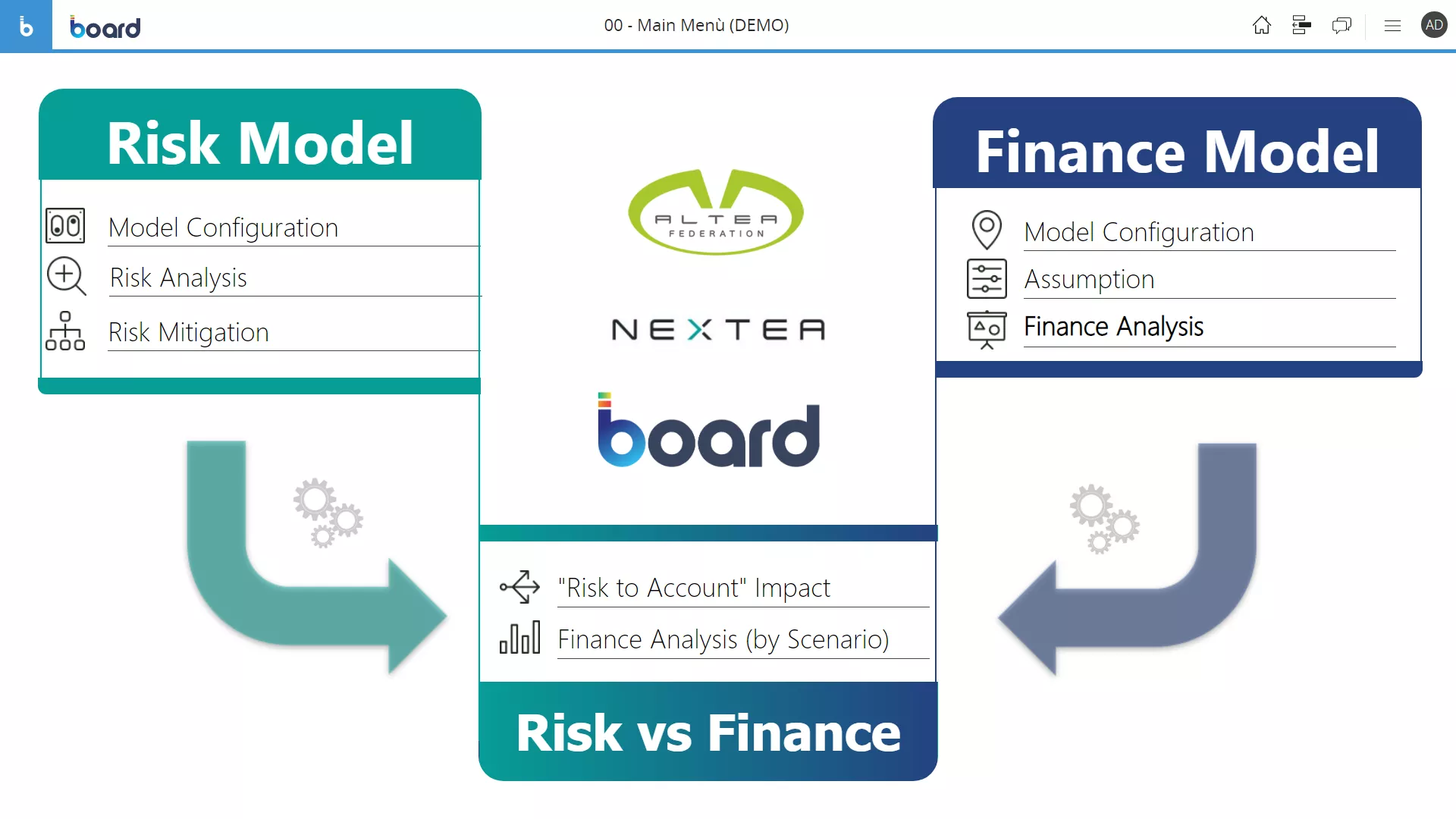

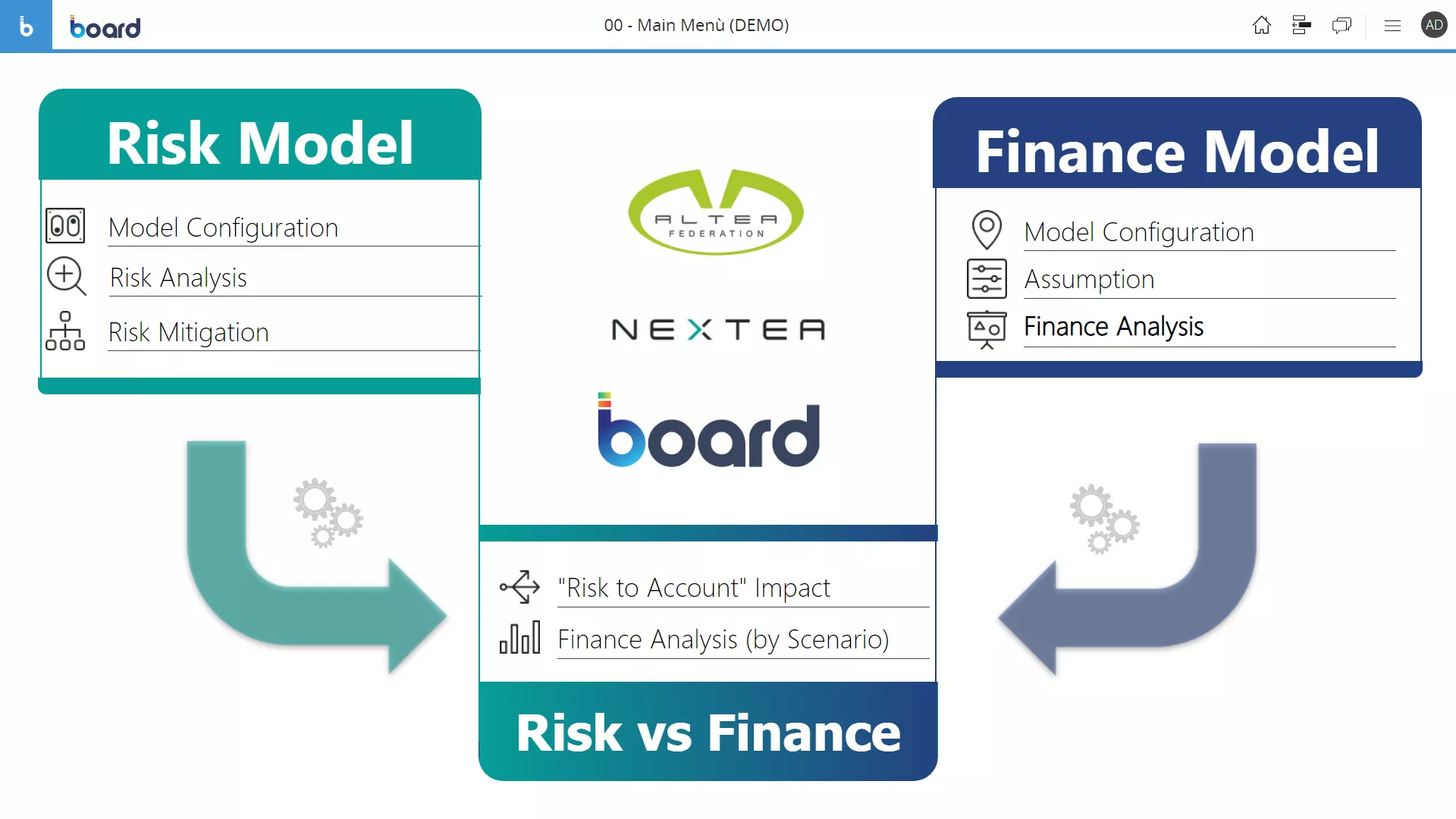

Nowadays more and more companies are adopting risk management models to act proactively trying to avoid risks’ occurrence or to limit their impact.The “NEXTEA Adaptive Resilience model” supports companies by effectively combining risk management and financial planning processes thanks to three different modules:

1. Risk Management, to drive the business through risk assessment and risk monitoring processes

2. Finance Planning, to implement income statement, balance sheet and cash flow based on assumptions

3. Risk vs Finance, linking the two previous modules and allowing to evaluate risks’ impact from a financial point of view using a multi-scenario analysis

All modules are integrated but the first two can be also implemented independently from the others.

A solution by Nextea

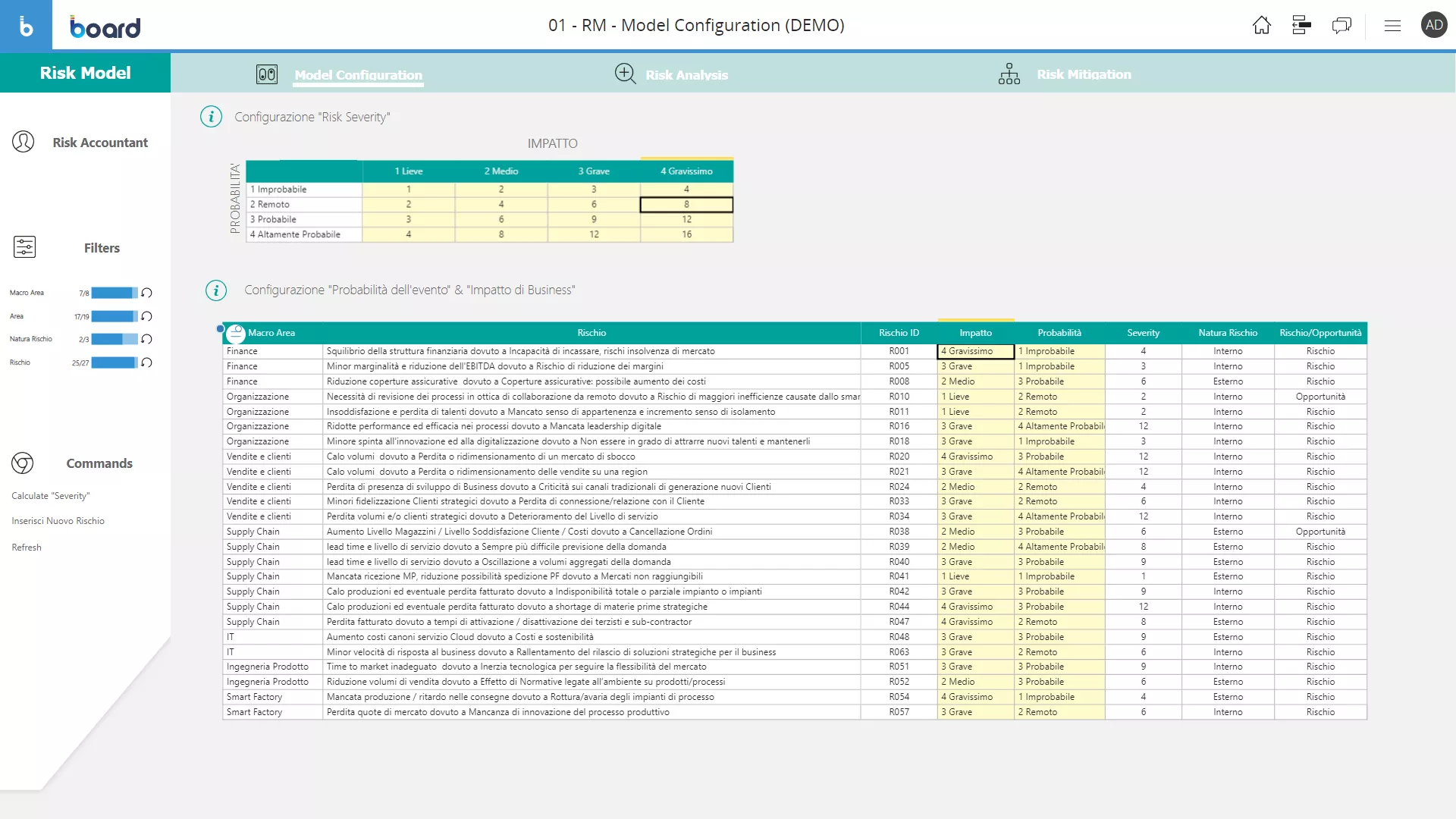

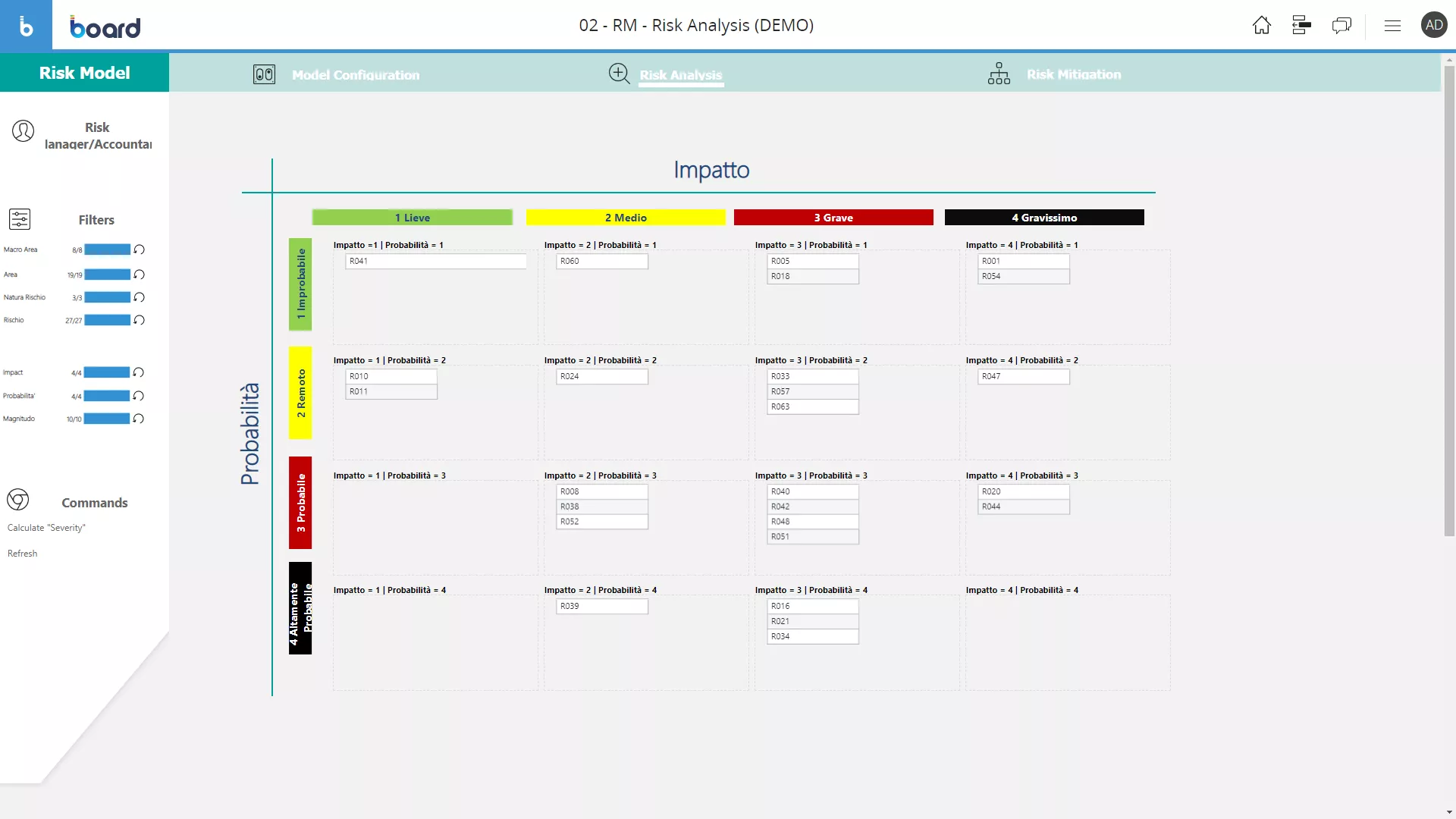

The “Risk Management” module allows:

- Mapping risks during risk assessment process

- Setting qualitative parameters to calculate risk severity

- Identification of most critical risks and assigning each one to a responsible

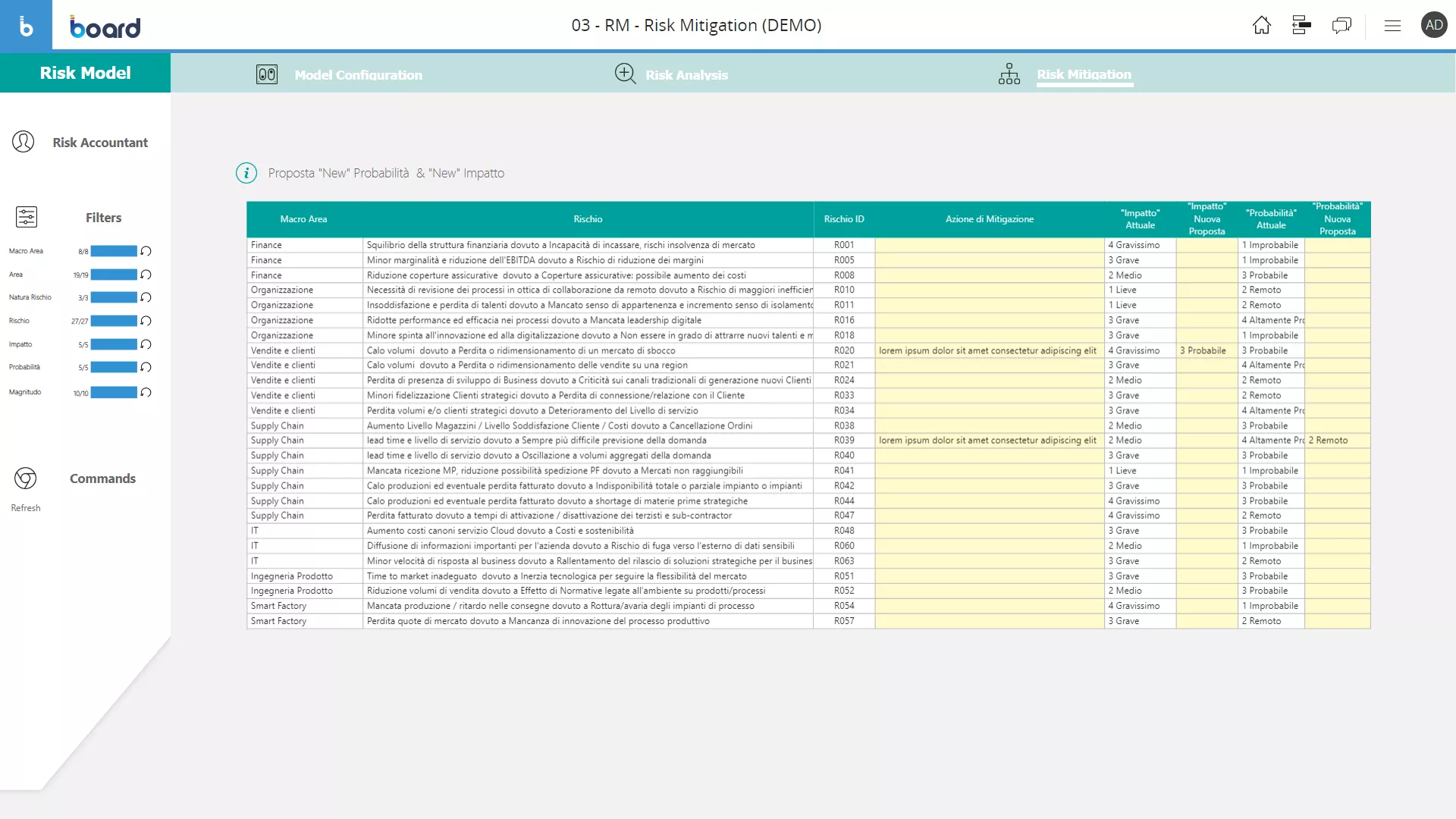

- Monitoring the risks and the effect of mitigation actions to lower their probability or impact

- Collaboration process between different company stakeholders

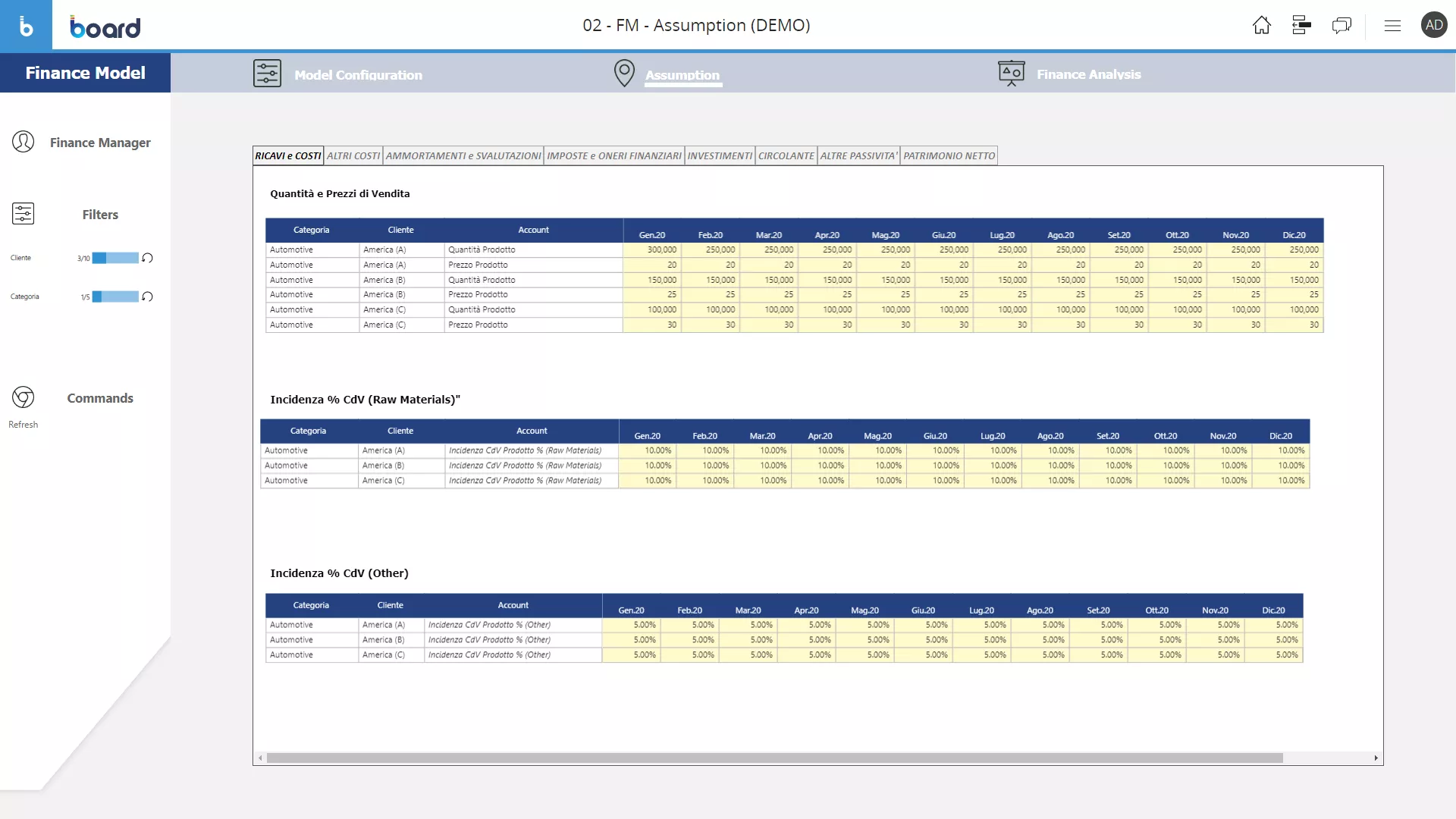

The “Finance Model” is used to develop the previsional income statement, balance sheet and cash flow and it is composed by two main areas: Assumption and Finance Analysis.

In the Assumption section, values for each element (Sales, COGS …) can be managed at different aggregated levels based on customer needs (i.e. price and quantities or total net sales value).

In the Finance Analysis area, the company income statement, balance sheet and cash flow are calculated thanks to the values managed in the Assumption section.

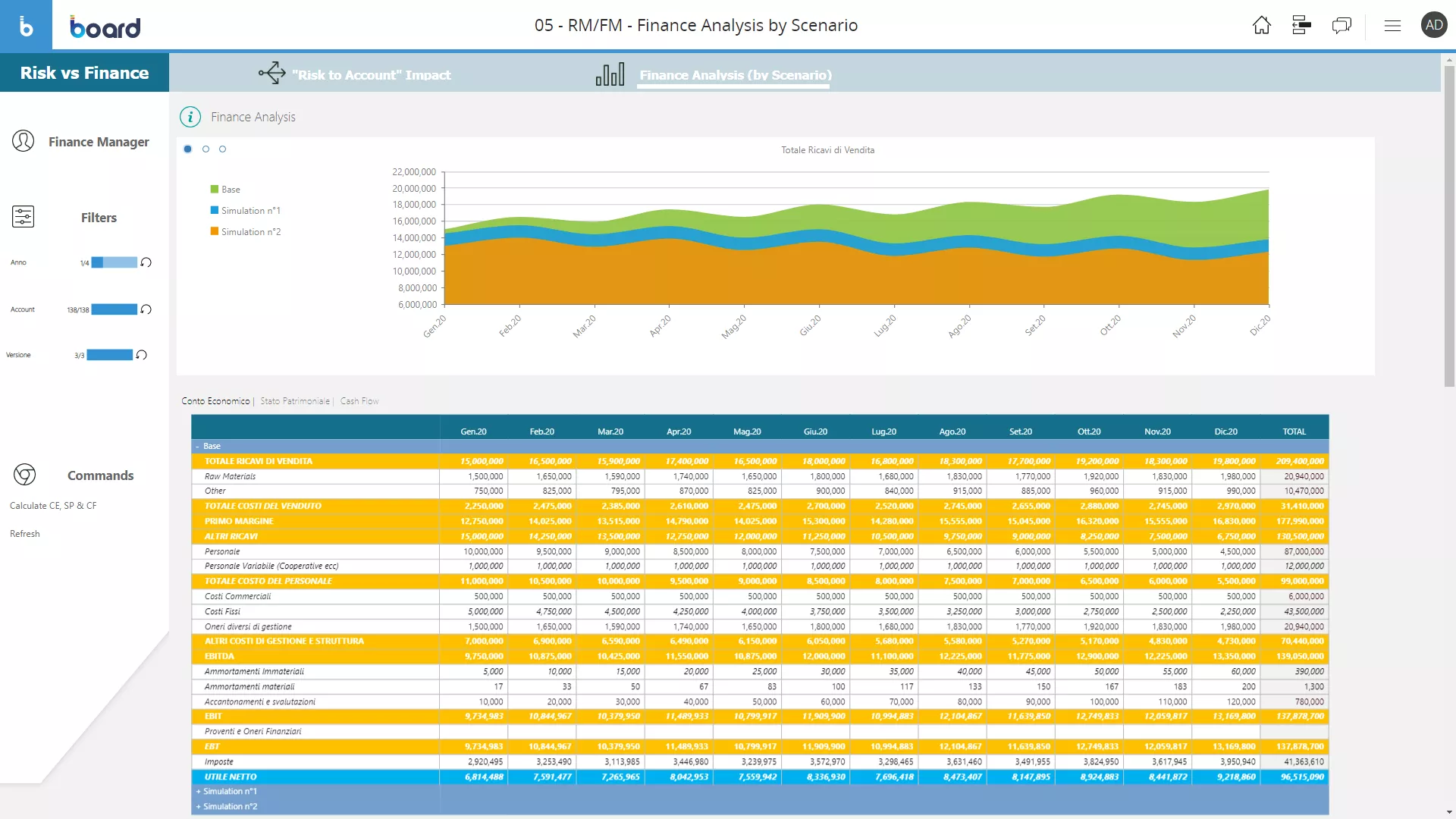

The “Risk vs Finance” model allows Management to evaluate risks’ effects on Financial Planning using a multi-scenario analysis. The relationship between accounting items makes it possible to analyze the economic and financial impacts if the assumptions vary.

For each scenario can be set a list of risks to be valuated and their quantitative impact: then the system generates a new version of the income statement, balance sheet and cash flow that can be compared with the official company Financial Planning or with other simulations.