[Board is a] scalable and flexible planning solution that responds effectively to all of our technical and functional requirements.”

Philippe Martelo

This website will offer limited functionality in this browser. We only support the recent versions of major browsers like Chrome, Firefox, Safari, and Edge.

CFOs are under unprecedented pressure. Market volatility, rising interest rates, and escalating stakeholder expectations mean that oversight and compliance are no longer enough. Boards and investors expect foresight, agility, and growth leadership. Finance transformation is not optional — it is the foundation for resilience, profitability, and long-term value creation. Independent benchmarks underscore the urgency. McKinsey finds that companies with digitally enabled finance functions outperform peers, with above-growth industry more likely. Gartner reports that 80% of CFOs are accelerating finance digital initiatives to improve decision speed and accuracy.

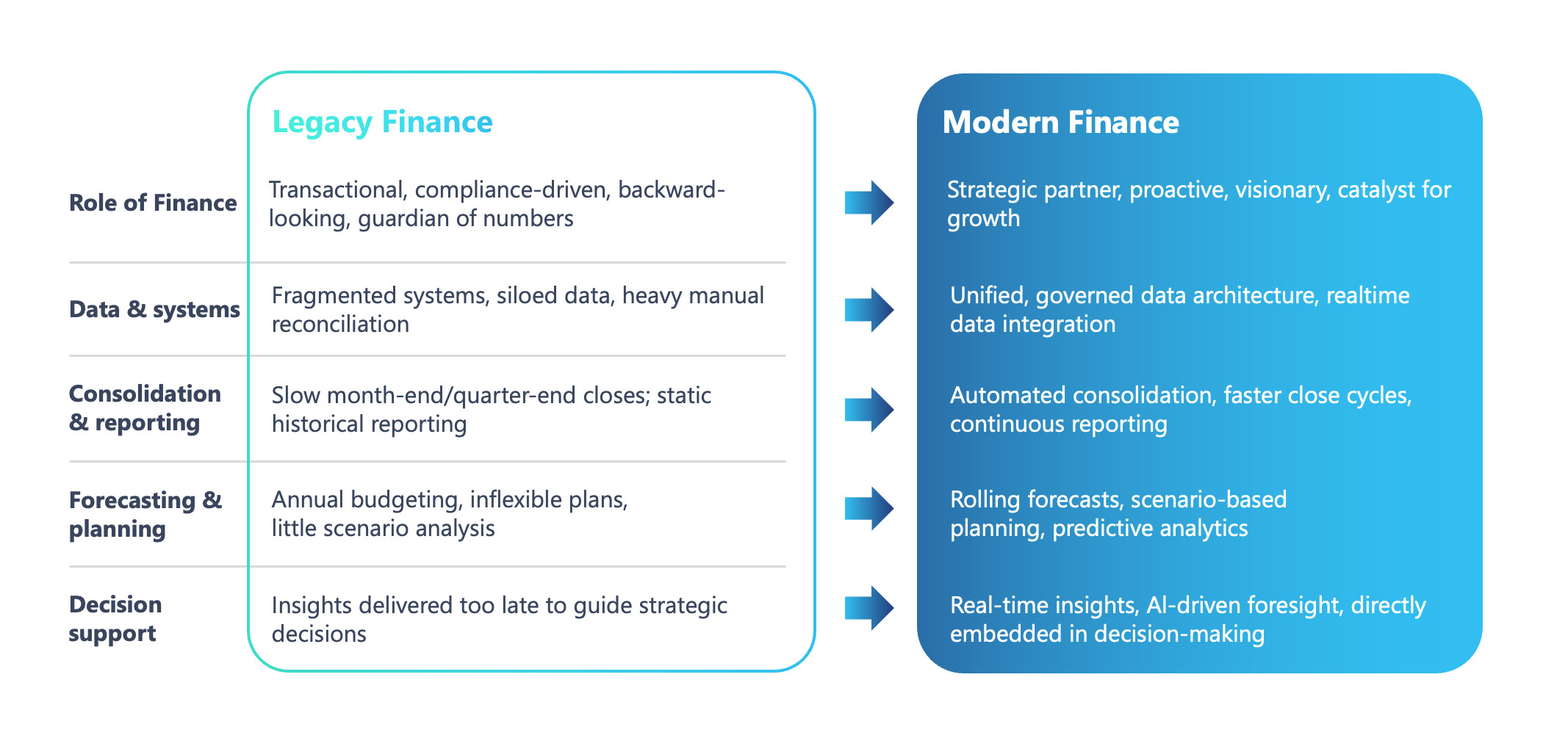

Traditional processes like manual consolidations, siloed data, and static forecasts cannot keep pace with the demands of today’s markets. They consume valuable resources while leaving the enterprise exposed to shocks and missed opportunities. By leveraging advanced planning, AI-driven forecasting, and real-time performance management, CFOs can shift the function from a reporter of history to a catalyst of enterprise-wide growth by unlocking capital efficiency, accelerating decisions, and strengthening confidence.

The imperative is clear. CFOs who embrace finance transformation will position their organizations for resilience and value creation, while those who delay risk eroding competitiveness and trust. This paper outlines why finance transformation is essential, what a modern finance function looks like, and how leading organizations are already realizing measurable impact.

Finance leaders today face a widening gap between what is demanded of them and what traditional processes can deliver. Slow closes, fragmented data, and static forecasts consume valuable time while leaving the enterprise exposed to risk. Manual reconciliations and backward-looking reporting erode agility at the very moment boards, investors, and regulators are demanding sharper foresight and faster action.

The vision is clear — finance must evolve from record-keeper to strategic partner. A transformed finance function delivers faster, more confident decisions, sharper risk management, and higher returns on capital. It provides leadership with real-time insight into performance, enables rolling forecasts that anticipate change, and builds the credibility that underpins stakeholder trust. According to Accenture’s CFO Forward 2024 study, companies that align their transformation ambition with the disruption they face are twice as likely to achieve their desired benefits and outcomes. In volatile markets, this ability to translate finance transformation into measurable impact is what separates those who lead from those who fall behind.

Most finance leaders have invested in digitization and automation, but progress often remains fragmented, with adoption often confined to pilots or individual processes. The leadership opportunity now is to scale these efforts across the enterprise, particularly in emerging areas like generative AI and long-term resource allocation according to McKinsey.

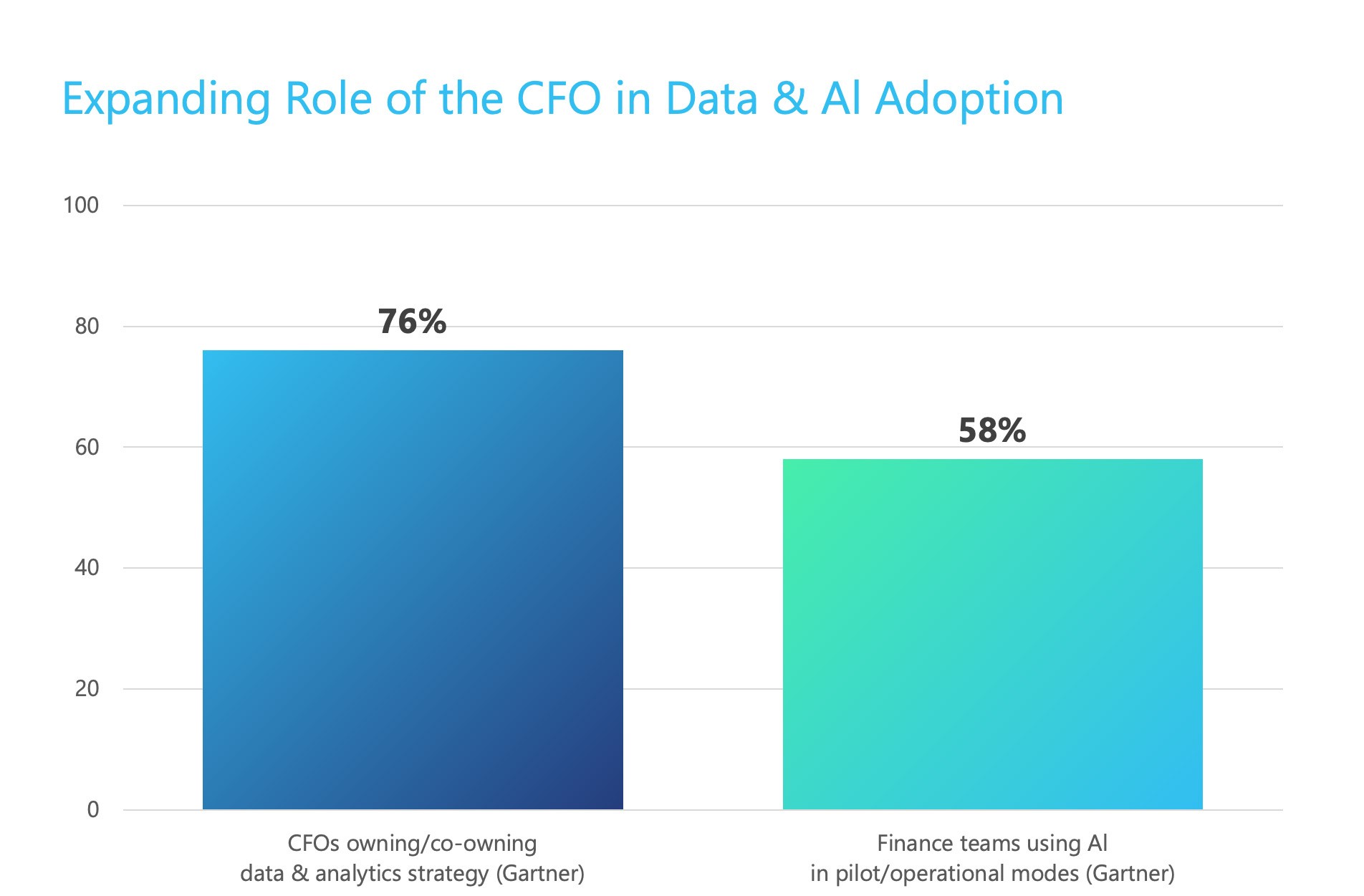

The consequences of delay or underinvestment are material. Companies that fail to modernize their finance functions are slower to anticipate shocks, less able to optimize capital, and more constrained in shifting strategy. They remain trapped in cycles of lengthy closes, manual reconciliations, and static forecasts that quickly lose relevance. By contrast, organizations that commit to transformation reduce the cost of finance, shorten cycle times, improve forecast accuracy, and build stronger market credibility. Gartner reports that 76% of CFOs now own or co-own enterprise data and analytics strategy, underscoring how central finance has become to strategic insight. Meanwhile, 58% of finance teams are already using AI in pilot or operational modes, making it imperative to move quickly from experimentation to material impact.

For CFOs, finance transformation is no longer optional. It is the foundation for resilience, growth, and long-term value creation.

McKinsey notes that while nearly every finance function has adopted some digital tools, most remain only partially digitized, with fragmented systems and backward-looking processes limiting their impact. Static reporting and manual reconciliations consume time and provide little foresight, leaving leadership reactive rather than proactive.

The vision for modern finance is different. Finance must become predictive, automated, and fully embedded in enterprise decision-making. Instead of spending weeks reconciling numbers, modern teams provide real-time insights, leverage AI-driven forecasting, and unify financial, strategic, and operational planning on one platform for a single source of truth. The result is a function that shapes corporate strategy, accelerates decisions, and builds investor confidence by delivering consistent, forward-looking guidance.

This shift is not aspirational — it is measurable. Gartner research shows that 53% of CFOs are revising their scenario planning processes to cope with policy and economic uncertainty, underscoring the demand for real-time foresight. Generative AI is rapidly becoming a core capability, not just a curiosity. Gartner finds 56% of finance functions plan to increase their AI investments by at least 10% in the next two years. BCG reports that early adopters of AI in finance see 20–40% efficiency gains, forecasting accuracy improvements of more than 50%, and decision-making that happens roughly twice as fast. These efficiency and accuracy gains free finance teams to focus on value creation, capital deployment, and risk insight—direct levers of shareholder confidence. And these outcomes show that the move from legacy to modern finance is both achievable and essential.

The modern finance function also requires new talent and leadership. Boards increasingly expect CFOs to build digitally fluent teams capable of combining financial acumen with business insight. The Hackett Group’s What’s the Digital World Class® Finance Advantage 2023 report finds that top quartile finance organizations operate at 47% lower cost than peers with 50% fewer full-time equivalent (FTE) staff. This is proof that transformation is not only about agility but also cost efficiency.

Equally important, resilient finance functions balance technology with governance. Gartner research finds that 73% of finance teams favor a centralized, governed source of truth for data, yet only 3% have fully integrated strategic, operational, and financial planning cycles. According to Gartner’s Finance 2030: 8 Forces Shaping the Future of Finance, agentic AI will handle at least 15% of day-to-day finance decisions, while 70% of finance functions will use AI for real-time decision-making by 2030. This future is not distant — it is unfolding today. Modern finance is characterized by rolling forecasts, predictive analytics, unified planning cycles, and teams that devote more time to analysis and decision support than to data reconciliation.

There is a clear shift from manual and reactive to automated and strategic, from fragmented insights to trusted foresight. For CFOs, this vision is not optional, but is the roadmap to delivering resilience, agility, and sustained enterprise value.

For CFOs, transformation is not only about driving growth, but also about protecting the enterprise from risk and ensuring resilience in uncertainty. Leading companies are strengthening their finance foundations to reduce operational exposure, eliminate error-prone processes, and gain real-time visibility into performance. The experiences of Groupe SEB and Coca-Cola Europacific Partners (CCEP) show how modern finance builds resilience by mitigating compliance and reporting risks, reducing dependency on manual processes, and equipping leadership with trusted insights to navigate volatility.

Groupe SEB: Agility Across 150 Subsidiaries

[Board is a] scalable and flexible planning solution that responds effectively to all of our technical and functional requirements.”

Philippe Martelo

Coca-Cola Europacific Partners: Integrated Driver-Based Planning & Massive Automation

By the click on a button and a few calculations and algorithms working in the background, we are able to immediately gain full control of the operational data. In fact, we can immediately get a fully-fledged plan, and this is exactly the concept of bridging finance teams with their operational business partners and making them talk to each other.

Ivan Evstatiev

These cases illustrate how modern finance strengthens both performance and resilience. By unifying planning and reporting, automating routine work, and equipping finance with real-time insight, organizations like Groupe SEB and CCEP show how the function transforms from a reporter of history to a driver of enterprise value. The benefits are concrete — confident decisions, faster pivots in volatile markets, stronger risk control, and greater confidence from stakeholders.

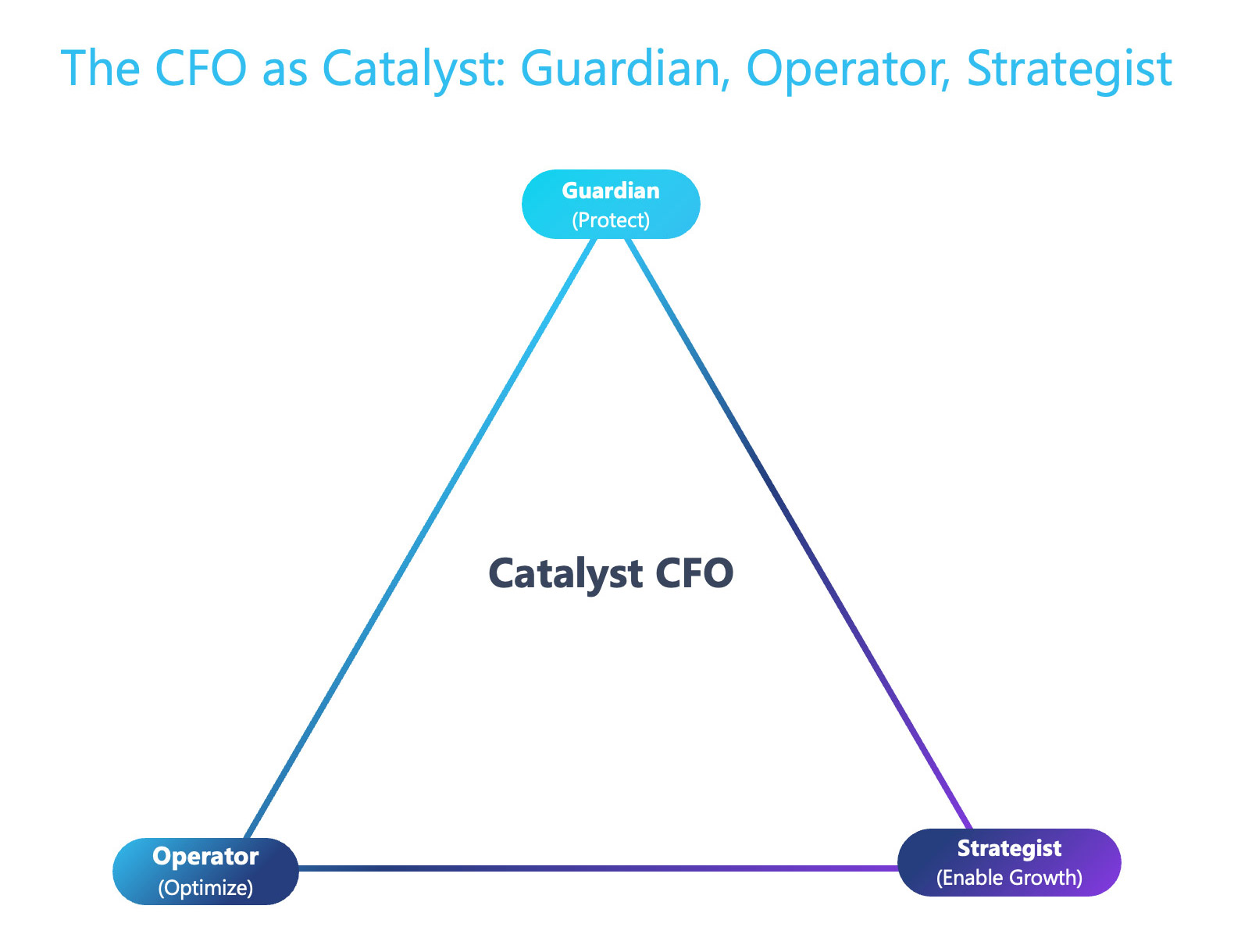

Modern CFOs are no longer just financial reporters or risk managers. They are the catalyst for enterprise transformation. Boards and investors increasingly expect CFOs to lead from the front, balancing integrity with agility and shaping the direction of the business in real time.

The role can be defined through three lenses:

These three roles converge in the CFO’s mandate as Catalyst, driving transformation across finance and the enterprise. Catalyst CFOs are change leaders, mobilizing teams, building digital and analytical talent, and embedding a culture of agility and accountability. They bring confidence and clarity to the finance teams, boardroom, investors, and other stakeholders.

What can CFOs do tomorrow to start embodying this role? That may mean automating manual processes, embedding finance leaders deeper into business units, or launching a talent upskilling initiative. The point is to start. CFOs who embrace the Guardian–Operator–Strategist concept position finance as both protector and accelerator, ensuring resilience today and value creation tomorrow.

The pressures facing CFOs today, volatile markets, rising stakeholder expectations, and relentless technological change, cannot be met with yesterday’s tools and processes. Finance leaders who cling to legacy systems and static planning cycles risk leaving their organizations exposed to shocks, outpaced by competitors, and undervalued by investors.

By contrast, CFOs who embrace transformation position finance as both guardian of integrity and catalyst for growth. Independent research shows the payoff is material. Accenture finds companies aligning their transformation ambition with disruption are twice as likely to achieve their desired outcomes, while Hackett benchmarks reveal world-class finance functions operate at nearly 50% lower cost than peers. Transformation is not just about efficiency — it’s about earning investor confidence, enabling faster pivots, and creating long-term enterprise value.

Where should you start? Assess where manual work and fragmented data still hold you back. Prioritize one quick win, whether it’s accelerating the close cycle, automating reporting, or embedding rolling forecasts. Then chart a transformation roadmap that not only digitizes processes but also elevates finance’s role across the enterprise.

There is a once-in-a-generation opportunity to redefine finance as the engine of resilience, agility, and value. The question is not whether transformation will happen, but whether you as CFO will lead it.

The 2025 Gartner® Magic Quadrant™ for Financial Close and Consolidation Solutions (FCCS)