IFRS 17 INSURANCE CONTRACTS

Key Features:

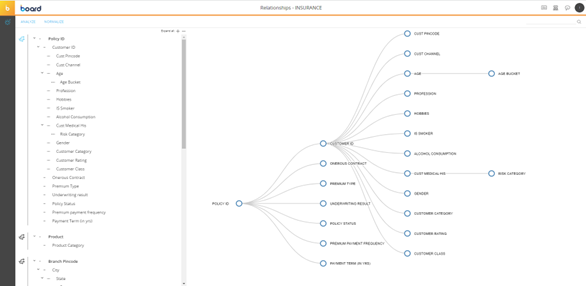

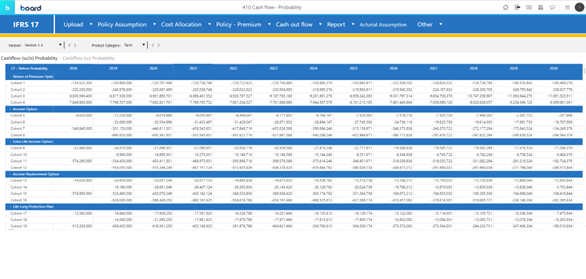

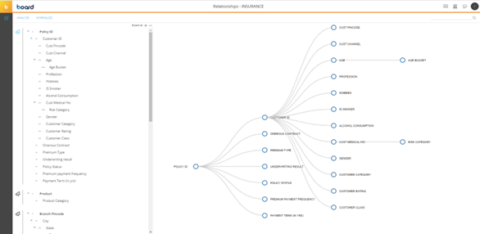

– Defining cohort & assumptions at cohort level

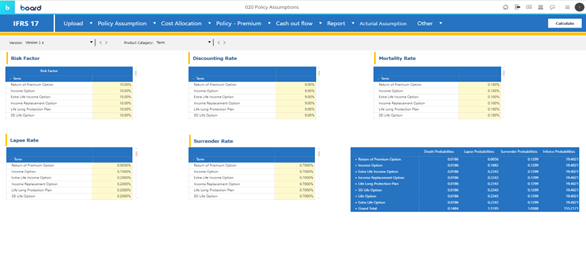

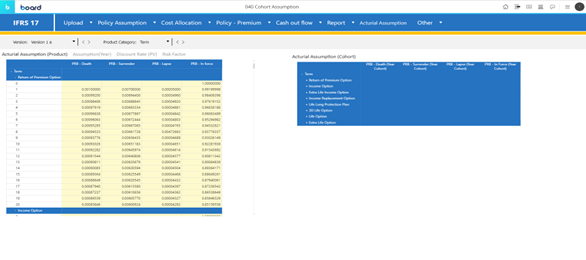

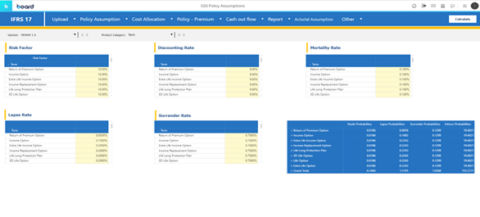

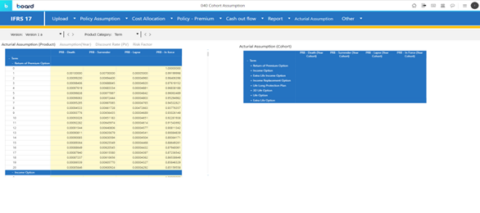

– Defining assumptions including discount factor, risk factor & other actuarial assumptions

– Defining in force policy at cohort level

– Combines current measurement of the future cash flows with the recognition of profit over the period that services are provided under the contract

– Presents insurance service results (including presentation of insurance revenue) separately from insurance finance income or expenses

– Requires an entity to make an accounting policy choice of whether to recognise all insurance finance income or expenses in profit or loss or to recognise some of that income or expenses in other comprehensive income

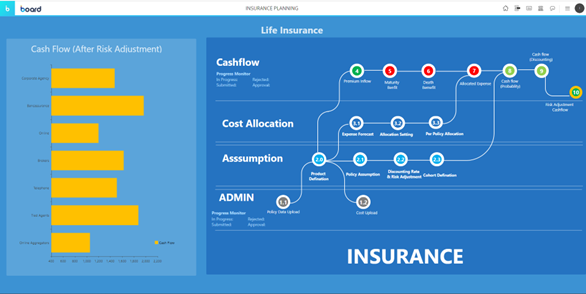

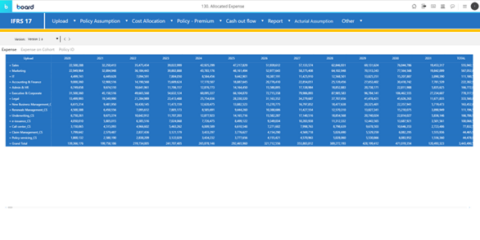

– Cost allocation

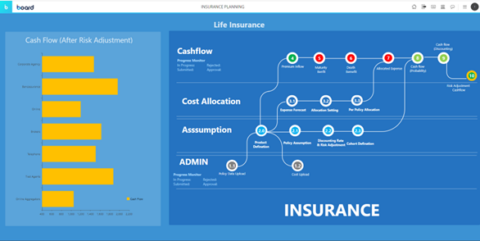

– Cash flow generation

The functionality for the Board application includes the following features:

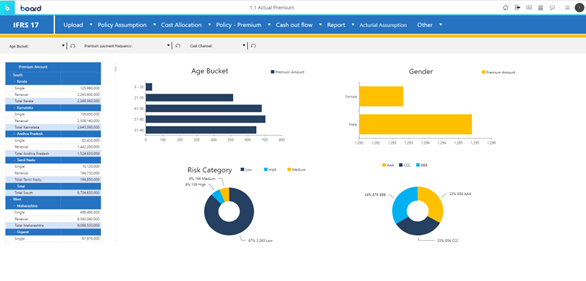

- Actual premium & expenses will be uploaded in Board application using smart object upload & Data Readers.

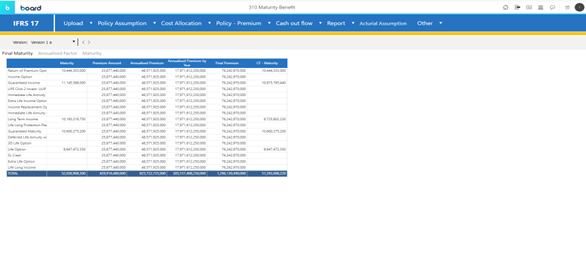

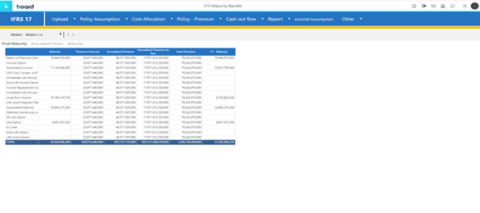

- Defining the policy assumptions i.e. product & cohort assumptions on the basis of maturity & death benefits.

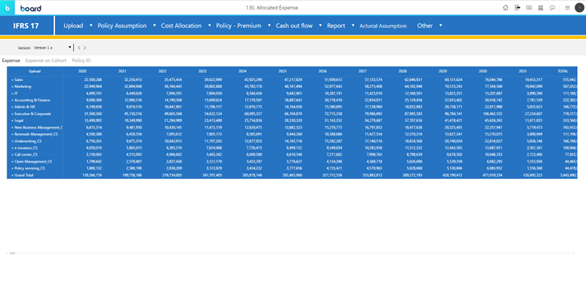

- In cost allocation, we are allocating expenses based on cost centers & GL grouping. Allocation matrix can be defined based on cost center, allocation driver & at cohort level.

- Expenses can be viewed by cost center , cohort & policy ID level.

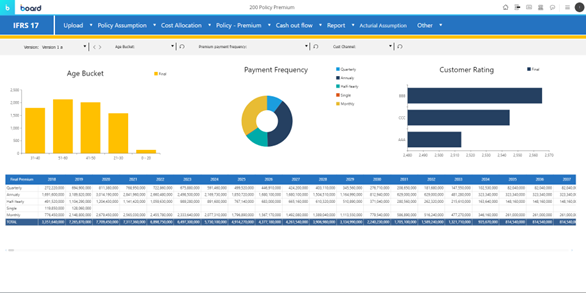

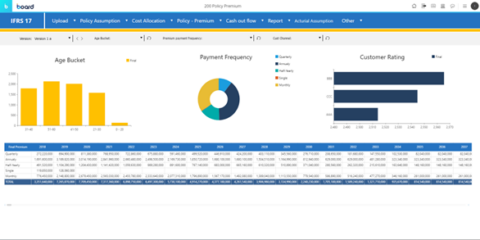

- Policy Premium can viewed based on age brackets , payment frequency i.e. Quarterly, Half yearly , Anually, Single & Monthly at customer rating with the help of different charts.

- Cash outflows include calculation of maturity benefits based on analysed factors & maturity value at different levels of frequencies.

- Death Benefits are calculated based on death % , death multipier , death benefit (% premium) & death compound interest.

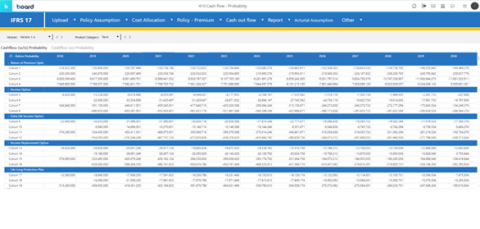

- Detailed & Summary Reports for cash flow reports are being prepared before & after probabilty. Moreover, Discounted & Risk Adjusted cashflows reports are also prepared.

- Actuarial Assumptions are also being provided for different product categories.

- Graphical representation of charts for different reports & process flow has also been prepared.

Want to see this solution in action?

Complete the form and our specialists will be in touch.

Other solutions