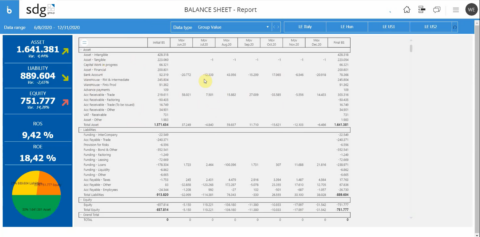

Cash & Liquidity Simulation

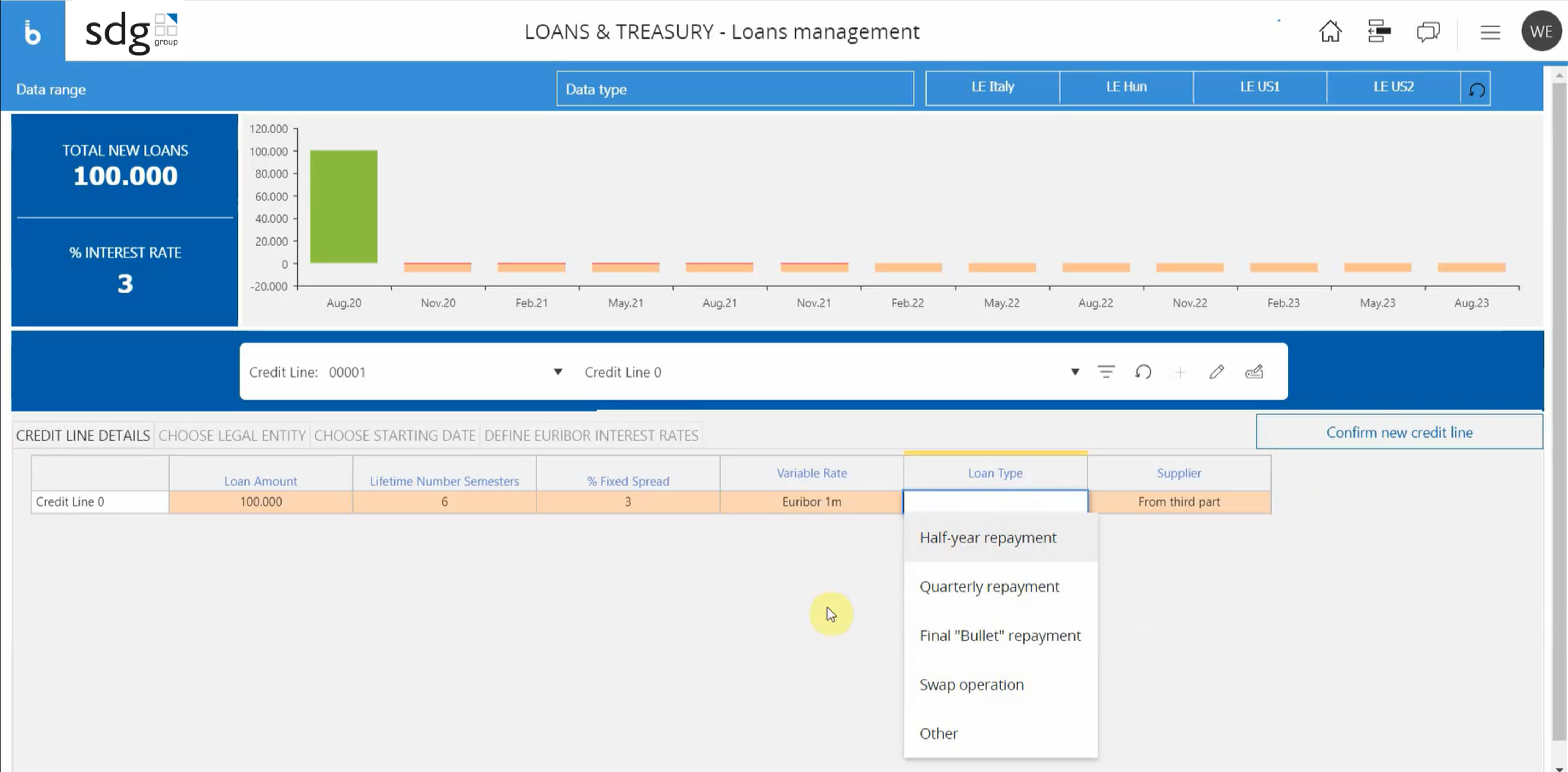

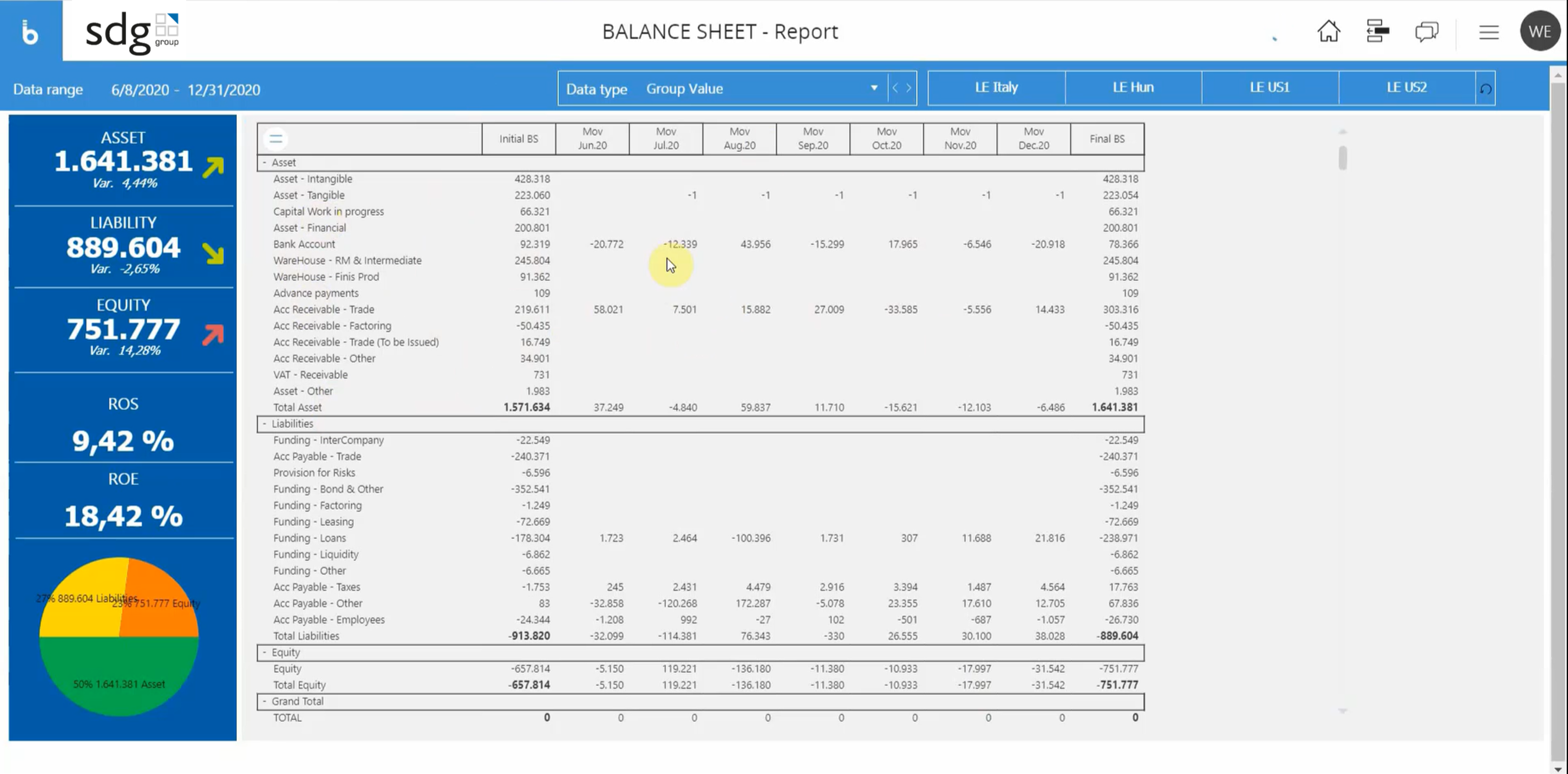

The tool leverages several cash drivers to your existing income statement plan and the latest trade balances across different planning scenarios. Through this process, the tool meticulously evaluates the cash implications of critical factors including Revenues, Cost of Goods Sold (COGS), HR Costs, Capital Expenditures (Capex), Account Receivables, Account Payables, and Financing. The power of scenario comparisons emerges as a guiding light for CFOs. By meticulously analyzing and comparing different scenarios, our solution offers profound insights, enabling your CFO to achieve and maintain a robust and secure cash position.

Key Features and Functionalities:

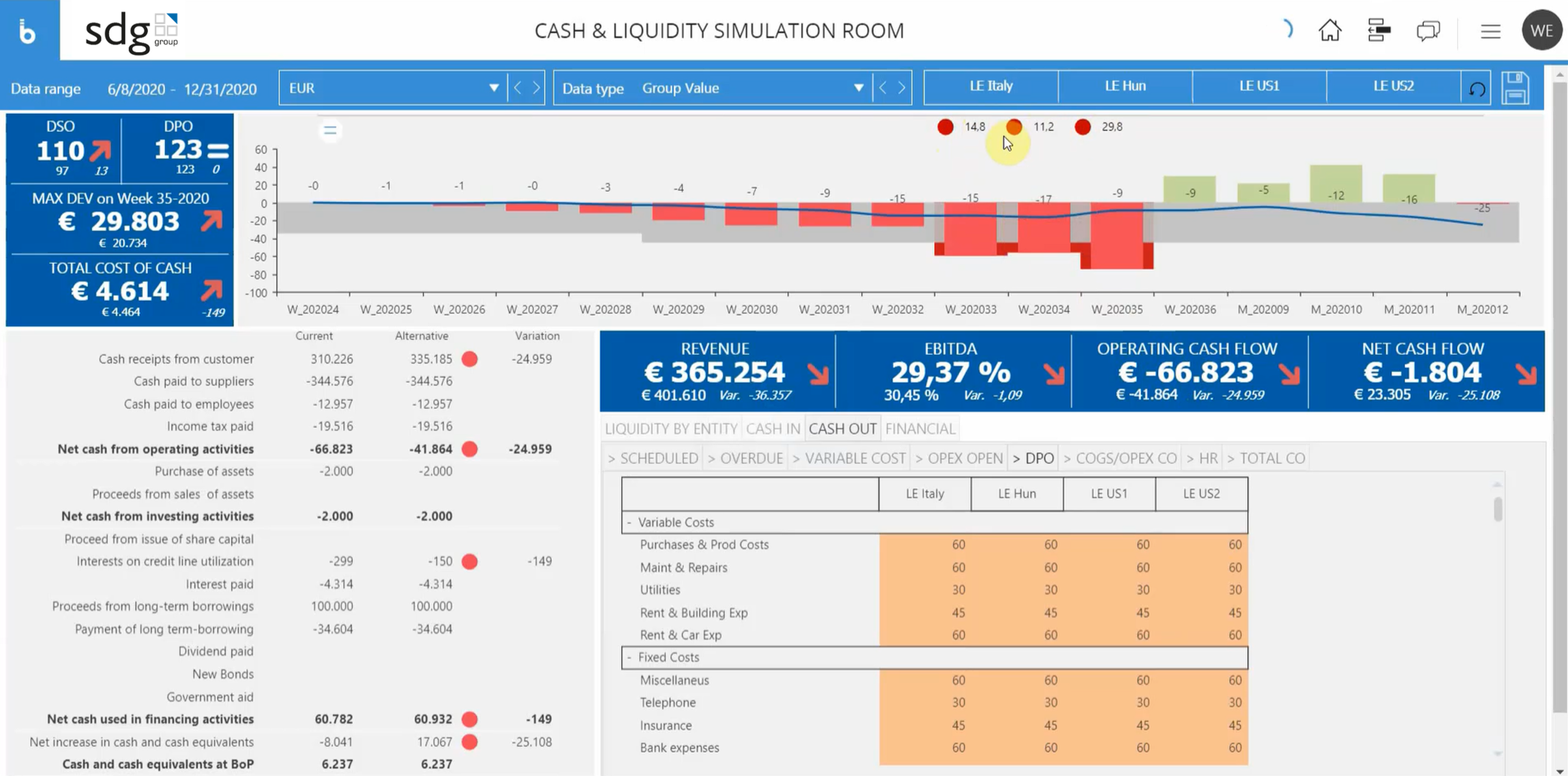

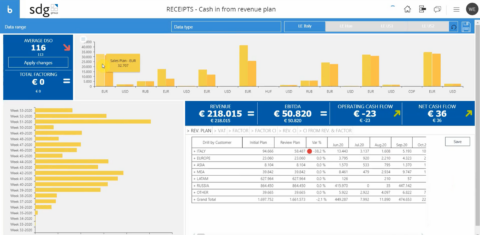

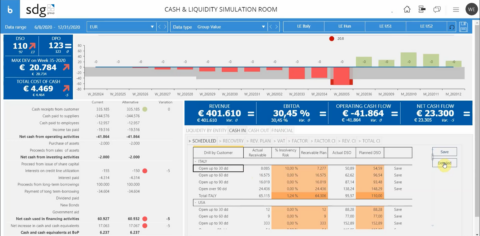

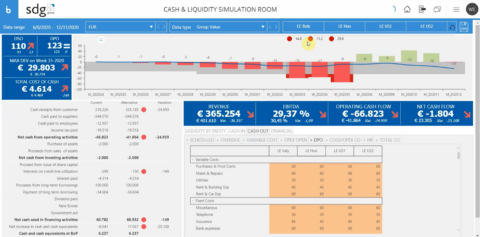

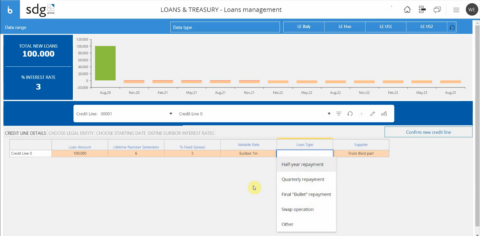

1) Empowering the CFO with the “Simulation Room”:

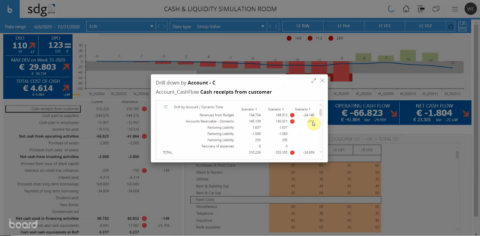

Effortless generation of multiple scenarios with a top-down view of Revenues, Costs, Net Working Capital, Cash, and other financial drivers. Real-time computation of liquidity or cash position with manual fine-tuning capabilities. Stress test engine for simulating outcomes across both realistic and hypothetical scenarios.

2) Unlimited Scenario Comparison:

Evaluate numerous scenarios and their underlying assumptions and facilitate the selection of the official and final version.

3) Effortless and Ongoing Re-Projections:

Simplify the re-projection of daily updated inputs (e.g. accounts receivable, accounts payable, revenues plan, etc.) for selected scenarios.

4) Rapid Simulation Turnaround:

Quickly initiate new simulation cycles, a crucial advantage during uncertain periods.

5) Prioritizing Precision and Data Integrity:

Facilitate informed and meticulous decision-making through accuracy and a data-centric approach.

Results:

- Accurate Month-end, Year-end liquidity projection.

- Elimination of complex cash flow Excel sheets.

- Streamline time spent in defining a liquidity forecast.

- Anticipate cash shortages and obtain financing in time.

- Quantify excess of cash and plan how to use it.

- Identify customers’ issues.

- Identify suppliers’ issues.

Want to see this solution in action?

Complete the form and our specialists will be in touch.

Other solutions