Direct Cash Flow Planning

Enhance your Cash Flow Planning

Embrace our monthly planning solution. It offers a streamlined and efficient platform for managing operational, financial and extraordinary cash flow rolling forecasts ranging 12 or more months, suiting both local company and largest group needs.

Get advanced features that allow integration, reconciliation, automation and real-time analysis of different economic scenarios.

Data Collection

Speed up your cash flow planning by integrating your ERP’s payables and receivables schedule, automating the integration of actual closing data from other Board models or external sources, and reducing manual input. This will save valuable time to your team.

From Economic to Cash Flow Planning

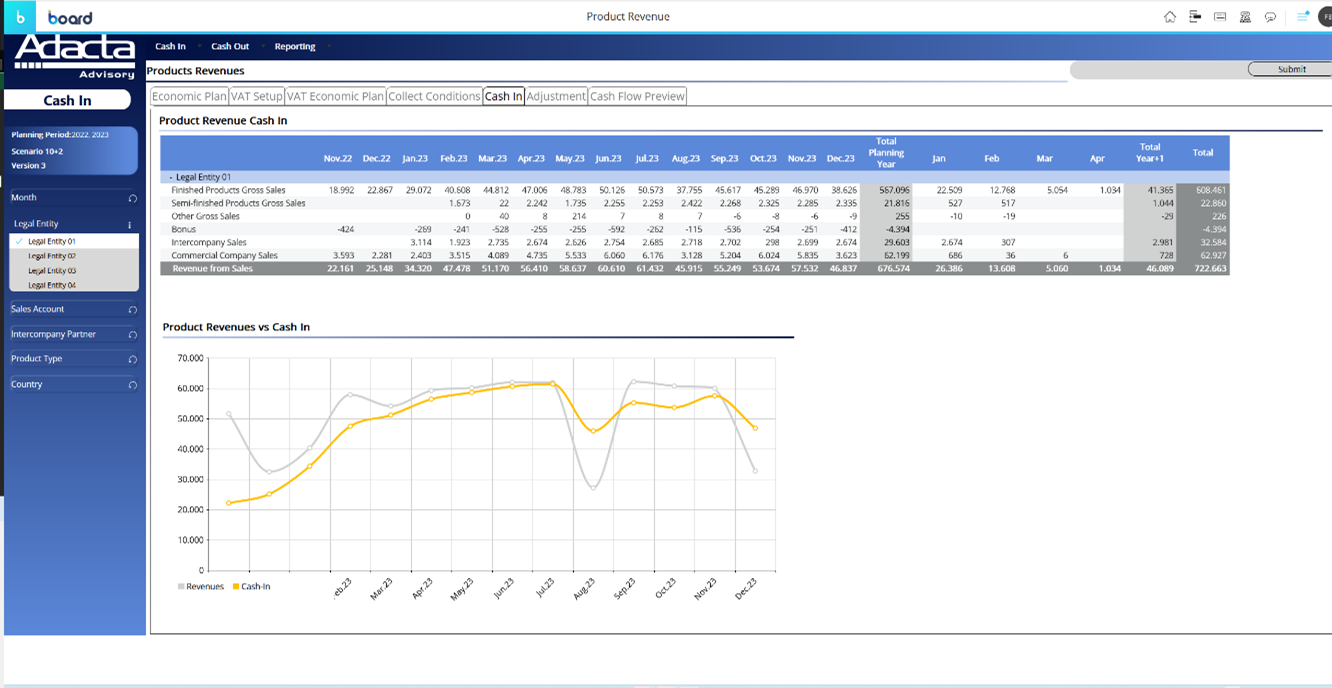

Plan your medium-long term cash flows by combining forecasts, budget, and strategic plan, including sales, capex, and HR planning for relevant insights. Use financial phasing and simulation based on collect and payment conditions for informed, data-driven decisions.

Easier Reconciliation Activities

Accelerate your reconciliation activities with ad-hoc designed dashboards; our solution eases this time-consuming process, allowing quick and efficient matching of:

- Cash flows vs economic planning

- Intercompany eliminations and funding

- Payables schedule vs debt accounts

The intuitive interface simplifies these complex tasks ensuring data quality across your organization.

Multi-scenario Planning & Real Time Analysis

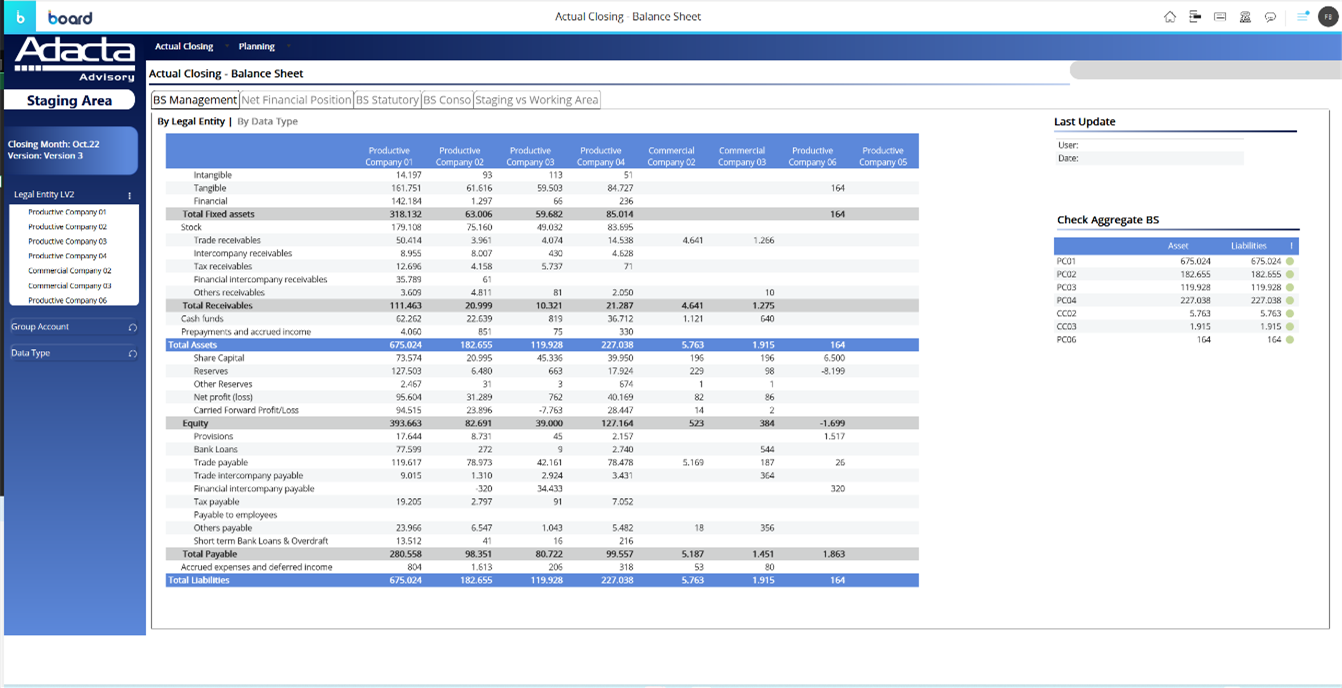

Deliver your cash flow and balance sheet with real-time performance across multiple economical and financial versions, obtaining data-driven insights to guide your decision-making process.

By using multiple scenarios, you will be able to:

- Test alternative funding measures

- Compare the financial perspective of different budgets and strategic plans

- Sizing the short-term facility for the next month

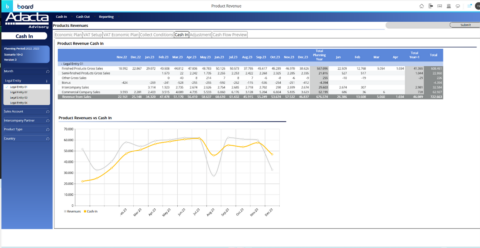

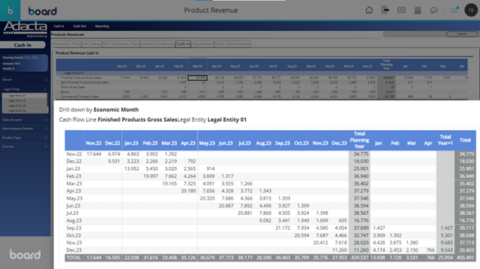

Reporting & Dashboarding

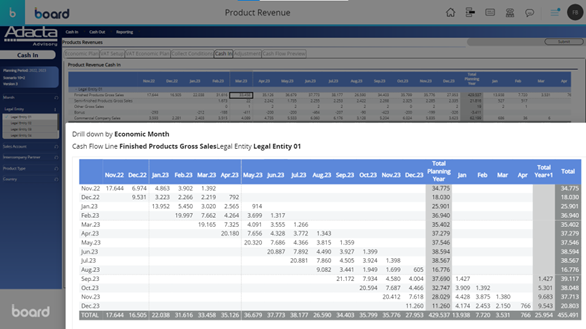

Prioritize high-value tasks like analysis and simulations minimizing manual activities. Use advanced reporting tools like drill-down and pivoting to navigate dynamic dashboards. Keep stakeholders informed with interactive reports, including Profit & Loss, Balance Sheet, Cash Flow, and Covenant KPIs to ease the monitoring and reporting of business performance.

Contact us today and take your financial planning to the next level

Want to see this solution in action?

Complete the form and our specialists will be in touch.

Other solutions